Twitter Timeline

[custom-twitter-feeds]

Categories

- Calculators (1)

- Company Research (295)

- Capricorn Investment Group (51)

- FirstRand Namibia (53)

- Letshego Holdings Namibia (25)

- Mobile Telecommunications Limited (7)

- NamAsset (3)

- Namibia Breweries (45)

- Oryx Properties (58)

- Paratus Namibia Holdings (6)

- SBN Holdings Limited (17)

- Economic Research (659)

- BoN MPC Meetings (13)

- Budget (19)

- Building Plans (142)

- Inflation (142)

- Other (28)

- Outlook (17)

- Presentations (2)

- Private Sector Credit Extension (140)

- Tourism (7)

- Trade Statistics (4)

- Vehicle Sales (143)

- Media (25)

- Print Media (15)

- TV Interviews (9)

- Regular Research (1,794)

- Business Climate Monitor (75)

- IJG Daily (1,597)

- IJG Elephant Book (12)

- IJG Monthly (108)

- Team Commentary (250)

- Danie van Wyk (61)

- Dylan van Wyk (27)

- Eric van Zyl (16)

- Hugo van den Heever (1)

- Leon Maloney (11)

- Top of Mind (4)

- Zane Feris (12)

- Uncategorized (6)

- Valuation (4,461)

- Asset Performance (115)

- IJG All Bond Index (2,067)

- IJG Daily Valuation (1,795)

- Weekly Yield Curve (483)

Meta

Category Archives: Economic Research

PSCE – September 2021

Overall

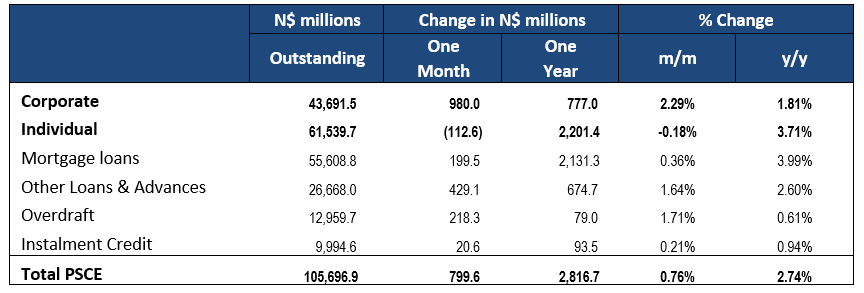

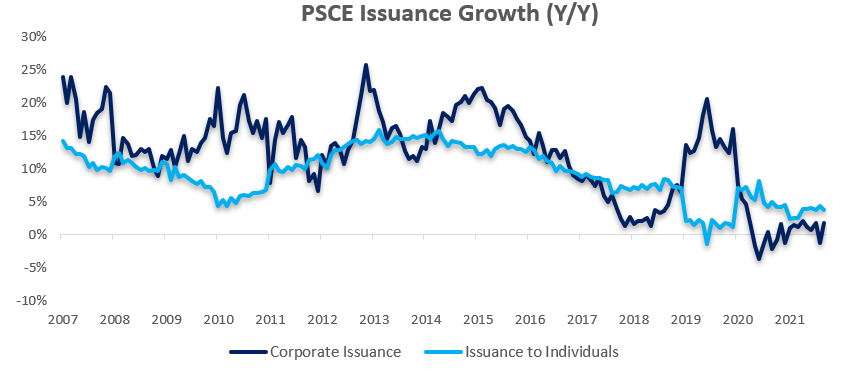

Private sector credit (PSCE) increased by N$799.6 million or 0.76% m/m in September. PSCE grew by 2.74% y/y in September, up from August’s increase of 1.85% y/y. On a 12-month cumulative basis, N$2.82 billion worth of credit was extended to the private sector. This represents an 89.9% y/y increase from last September’s 12-month cumulative issuance figure. This increase is due to base effects and does not indicate meaningful, above-trend growth in PSCE. Instead, PSCE growth has remained relatively stable, recording around 2.2% y/y growth over the past few months after faltering for much of 2020, hence the intermittent large year-on-year increases. Individuals continue to take up the majority of this cumulative issuance.

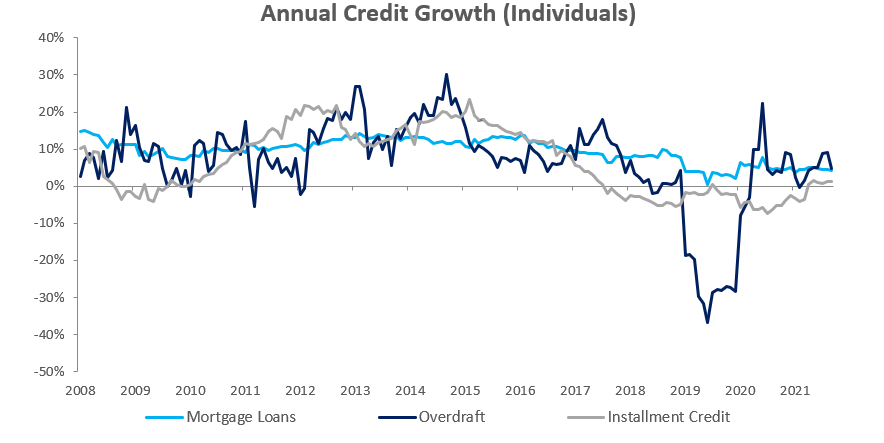

Credit Extension to Individuals

Credit extended to individuals decreased by 0.18% m/m but increased by 3.71% y/y in September. On a month-on-month basis, only one sub-category of loans and advances increased, namely mortgage loans by 0.1% m/m. The other two subcategories of loans and advances; namely other loans & advances and overdraft, shrunk in September by 0.7% m/m and 3.2% m/m respectively. Instalment credit grew by 0.2% m/m. On a year-on-year basis all subcategories of loans & advances, and instalment credit registered increases in September. Specifically, mortgage loans increased by 4.3% y/y, other loans & advances increased by 2.3% y/y and overdrafts grew by 4.8% y/y. Instalment credit issued to individuals grew by 1.3% y/y in September, marking the sixth straight month of year-on-year increases in this category. Prior to this streak, instalment credit shrunk year-on-year for the previous 20 months (back to August 2019). Despite structurally making up only 10-12% of the total credit extended to individuals, this sustained up-tick in instalment credit is perhaps an indicator of improving consumer demand. But again, this is a minor increase in a minor category and overall growth of credit extended to individuals remains sluggish.

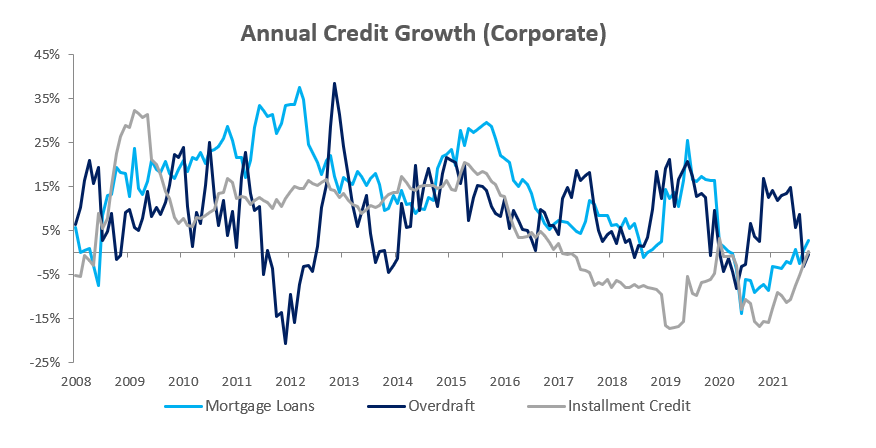

Credit Extension to Corporates

Credit extended to corporates grew by 2.29% m/m and 1.81% y/y in September. Total corporate loans & advances grew by 2.0% y/y in September, driven by increases in mortgage loans as well as other loans & advances with both sub-categories recording growth of 2.8% y/y. Overdrafts decreased by 0.3% y/y and instalment credit grew by 0.2% y/y. The month-on-month increase in corporate credit extensions was particularly strong in September, with the 2.29% m/m increase representing the largest month-on-month increase in 2021. This is due partially to base effects as August saw one of 2021’s largest month-on-month decreases in credit extensions to corporates.

Banking Sector Liquidity

The overall liquidity position of Namibia’s commercial banks decreased in September, falling by N$398.3 million to an average of N$1.40 billion. The BoN attributes this to government borrowing activities resulting from a large September bond auction. Despite the decrease in liquidity, the total balance of repos outstanding decreased during September. The repo balance fell to N$907.7 million at the end of September after starting at N$1.27 billion.

Reserves and Money Supply

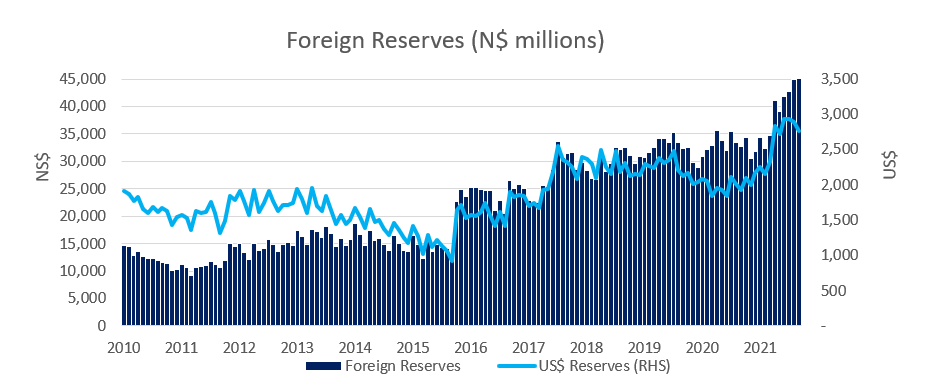

Broad Money Supply (M2) contracted by N$2.93 billion or 2.3% y/y in September, according to the BoN’s latest monetary statistics. The money supply also decreased by 0.1% m/m and now stands at N$122.9 billion compared to the N$123.1 billion at the end of August. The BoN made a significant revision to the international reserve balance for the month of August in the latest data. Previously the stock of international reserves was seen to decrease by 4.1 % m/m in August to N$40.9 billion. As per the latest data, the stock of international reserves for August instead increased to N$44.9 billion. Using this revised estimate, the BoN’s stock of international reserves rose by 2.1% m/m to N$45.9 billion in September. While the wording is unclear, the Bank of Namibia has attributed the increased level of international reserves (read – the August adjustment) to the IMF’s allocation of Special Drawing Rights (SDR) in August.

Outlook

PSCE growth in September remained subdued and broadly in line with the 2021 trend. We expect the Bank of Namibia’s MPC to keep interest rates at their current level for the remainder of the year, but pressure is growing on the South African Reserve Bank to increase interest rates. This is because inflation is hovering around the 5.0% mark, and with inflation risks to the upside, the SARB may need to hike rates to keep inflation below their 6% y/y targeted upper-bound. The SARB’s MPC meets on 18 November with a rate hike looking more likely than at any other point in the year so far. Should the SARB raise rates, the BoN will surely follow. While this will likely have a negative impact on PSCE, there is argument to be made that because PSCE growth has been, and remains, so subdued that perhaps a rate hike won’t make all that much difference.

Building Plans – September 2021

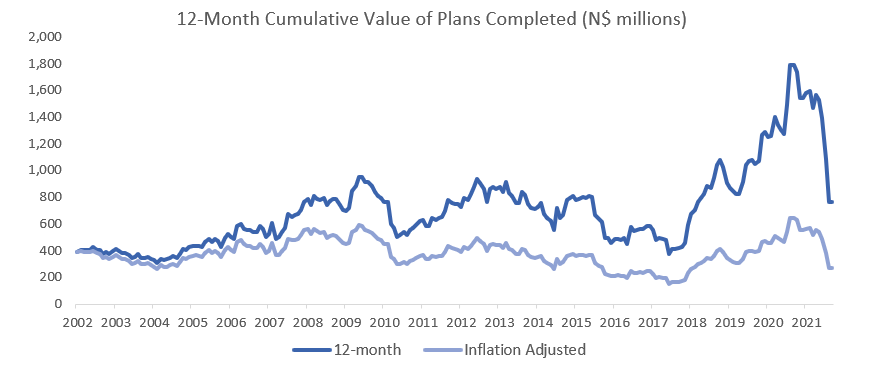

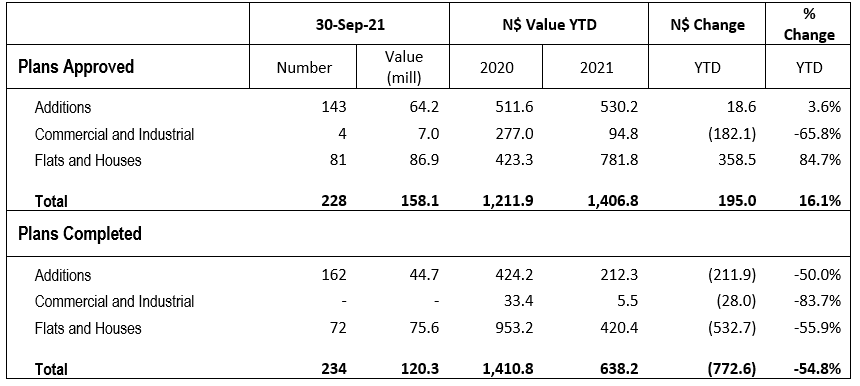

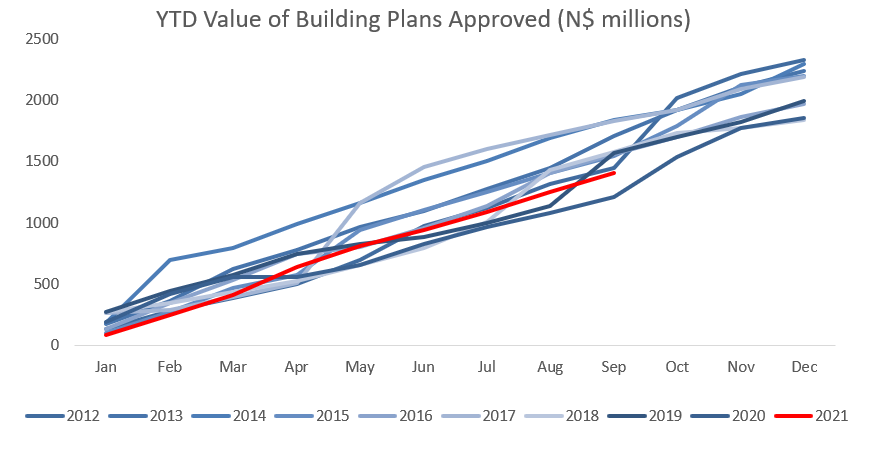

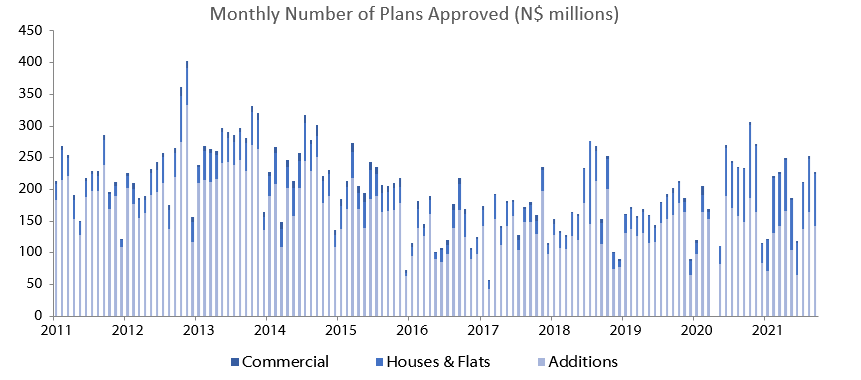

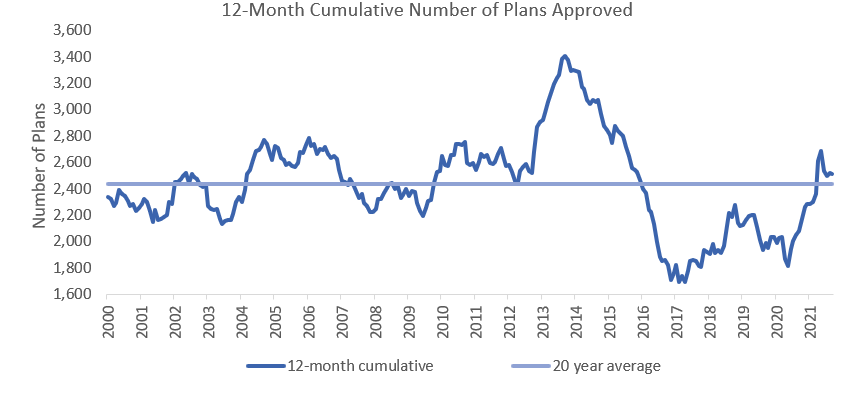

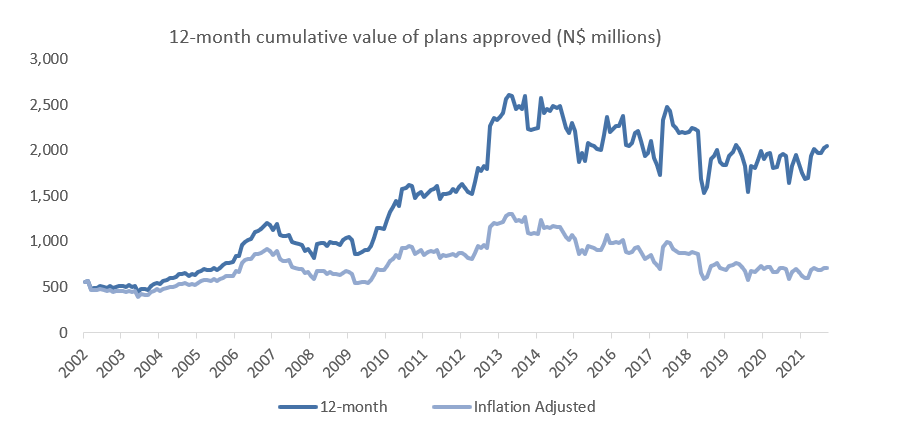

The City of Windhoek approved 228 building plans in September, a 9.9% m/m decrease from the 253 approved in August. The total value of approvals decreased by 2.2% m/m to N$158.1 million. So far in 2021 there have been 1,819 approvals, valued at N$1.41 billion. This year-to-date figure is 14.4% higher in number terms and 16.1% higher in value terms than at the same time last year. On a 12-month cumulative basis, the number of building plans approved rose by 20.7% y/y to 2,511, while the value of these approvals rose by 25.1% y/y to N$2.05 billion. 234 construction projects were completed in September at a value of N$120.3 million, a high in both number and value terms for the year. Year-to-date, 1,203 plans, valued at N$638.2 million have been completed, a 54.8% contraction in value terms compared to the same period a year ago. On a 12-month cumulative basis the value of completed projects is down 57.3% y/y.

Over the past decade additions to properties have averaged roughly 44% of the total value of approved construction projects. On trend, additions to properties made up 41% of the total value of approvals in September. 143 additions were approved at a value of N$64.2 million, a 13.3% m/m decrease in number, but a 12.5% m/m increase in value from the N$57.1 million approved in August. Year-to-date, 1,126 additions have been approved at a value of N$530.2 million, a 3.4% decrease in number, but a 3.6% increase in value from September 2020. Compared to the preceding three months September saw a large spike in the number and value of additions completed, with 162 additions completed in the month at a value of N$44.7 million. In fact, September saw a greater number, and value, of additions completed than in the previous three months (June, July and August) combined.

New residential units were the second largest contributor to the total number of building plans approved with 81 approvals. Residential units did however contribute the most value, with total residential approvals valued at N$86.9 million. In terms of value, that N$86.9 million represents a 3.3% m/m increase from August’s figure of N$84.1 million. Year-to-date, 664 units worth N$781.8 million have been approved. This represents a year-to-date increase in value of residential units of 84.7% y/y. On a 12-month cumulative basis, the number of residential units approved increased by 98.0% y/y and by 90.0% y/y in value.

72 new residential units were completed in September at a value of N$75.6 million. In terms of value, September was the best month for residential construction in Windhoek in 2021. On a 12-month cumulative basis, the number of residential units completed comes to 563 at a value of N$511.4 million and while this translates to a year-on year decrease of the 12-month cumulative figure, the number and value of completed residential construction projects from July through to September 2020 was unnaturally high. So, with those values now omitted from the 12-month cumulative calculations it is unsurprising to see that the 12-month cumulative value of residential units completed has decreased by 50.8% y/y in value. This has everything to do with those three months in 2020 seeing abnormally high figures for the value of completed projects (see last month’s report for a more detailed explanation of why that is) and nothing do with 2021 being an unusually slow year for residential construction.

In September four commercial units, valued at N$7.0 million, were approved. Year-to-date, 29 commercial buildings have been approved at a combined value of N$94.8 million. September also marks the sixth consecutive month with zero commercial building project completions. Over this time, 25 projects have been approved. So, while projects are not being completed the fact that commercial projects continue to be approved is encouraging, although the value of these projects are significantly smaller than they were pre-pandemic.

On a 12-month cumulative basis, the number of buildings completed fell by 30.5% y/y and 57.3% y/y in terms of value. As alluded to in the previous paragraph, and as explained in the conclusion of the previous report, there is a simple mechanical explanation for this and now the 12-month cumulative value of plans completed simply gives a more accurate picture of short-term construction trends than it did two months ago. Additionally, the year-on-year change of the 12-month cumulative value of plans completed will remain negative for several more months while the overall health of the construction industry is likely to hover around its early 2019 level.

12-month cumulative approvals do paint a better picture, with a 20.7% y/y increase in number terms and 25.1% y/y in value, however these increases are from a low base and the majority of approvals continue to be made up of additions to properties which are of lower relative value.