Overall

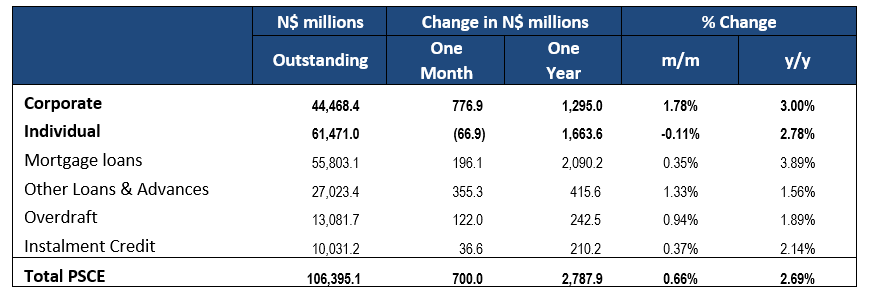

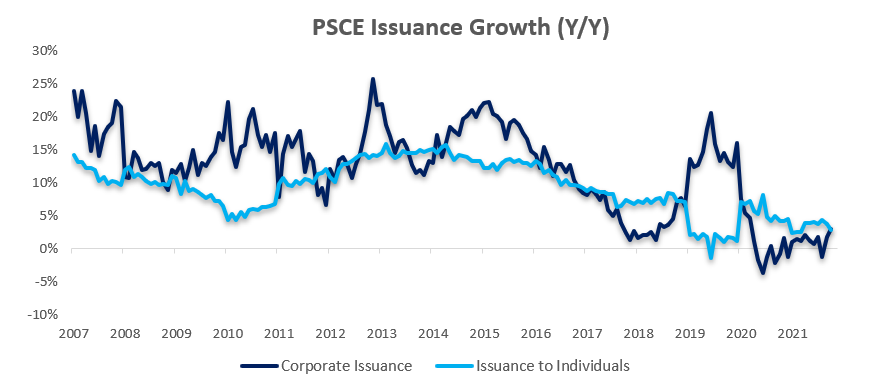

Private sector credit (PSCE) increased by N$700.0 million or 0.66% m/m in October, bringing the cumulative credit outstanding to N$106.4 billion. On a year-on-year basis, private sector credit increased by 2.69% in October, down slightly from growth of 2.74 % y/y in September. On a 12-month cumulative basis N$2.79 billion worth of credit was extended to the private sector. Individuals continue to take up the majority of this cumulative issuance. After two months of consecutive month-on-month declines in total claims on the private sector, in July and August, total claims have now risen month-on-month in both September and October. Over the long–term the outlook is less encouraging. From the start of 2015 until December 2019, PSCE grew by an average of 9.41% y/y. Since the start of 2020 average year-on-year growth has fallen to 2.75% y/y, despite several interest rate cuts last year. A positive reversion in this trend seems unlikely in the short-term.

Credit Extension to Individuals

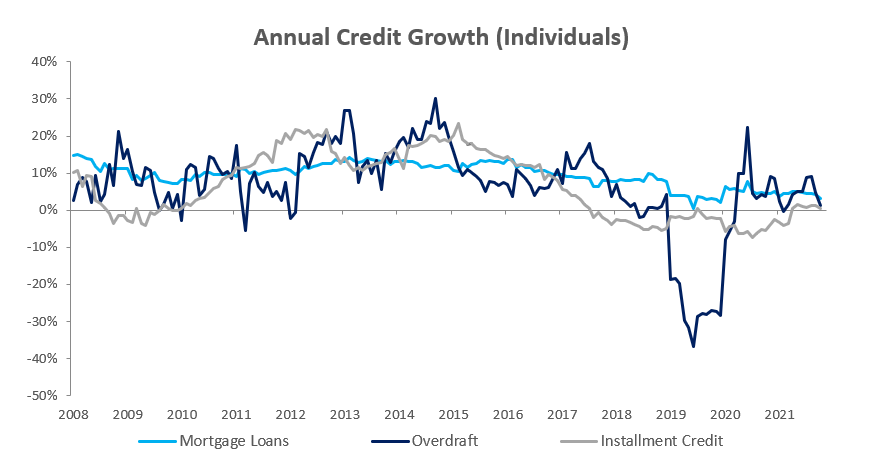

Credit extended to individuals decreased by 0.11% m/m but increased by 2.78% y/y in October. On a month-on-month basis, ‘other loans and advances’ (consisting of credit card debt, personal- and term loans) increased by 1.7% m/m. The other two subcategories of loans & advances, namely mortgage loans and overdraft, shrunk by 0.2% m/m and 2.2% m/m in October. Instalment credit shrunk by 0.8% m/m. On a year-on-year basis all subcategories of loans & advances registered increases in October. Mortgage loans increased by 3.2% y/y, other loans and advances grew by 2.6% y/y and overdrafts grew by 1.2% y/y. Overall growth of credit extended to individuals remains sluggish. In the four years prior to 2020, total credit extensions to individuals grew at an average of 8.1% y/y. Since 2020 that figure has fallen to 4.6% y/y.

Credit Extension to Corporates

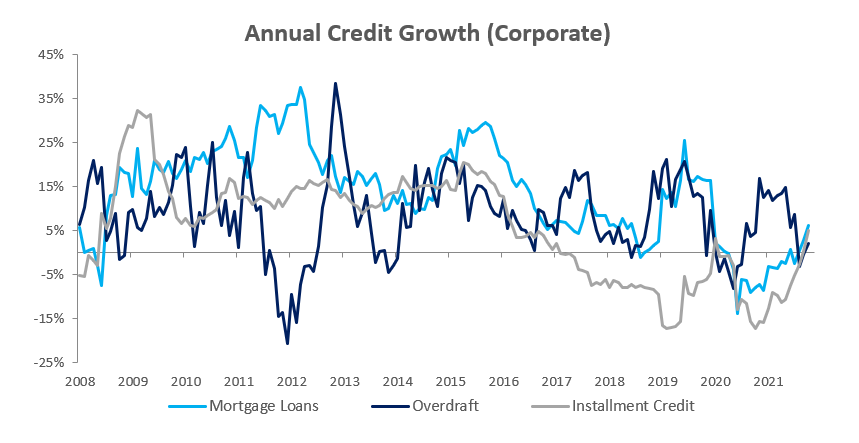

Credit extended to corporates grew by 1.78% m/m and 3.00% y/y in October. Total corporate loans & advances grew by 1.7% m/m. Specifically, mortgage loans grew by 2.3% m/m, other loans and advances grew by 1.3% m/m and overdrafts grew by 1.6% m/m. Instalment credit grew by 2.4% m/m. The trend is broadly similar on year-on-year basis. Total corporate loans & advances grew by 2.8% y/y in October, with all sub-categories recording increases. This is also the first time in 2021 that there have been two successive month-on-month increases in credit extensions to corporates, although the growth is subdued.

Banking Sector Liquidity

The overall liquidity position of Namibia’s commercial banks increased in October, rising by N$832.9 million to an average of N$2.23 billion. The BoN attributes the increase to cash inflows from diamond sales, coupon payments and increased government expenditure. Accordingly, the total balance of repos outstanding decreased in October. The repo balance fell to N$200.9 million at the end of the month after ending September at N$907.7 million.

Reserves and Money Supply

Broad Money Supply (M2) increased by N$5.70 billion or 1.0% y/y in October, according to BoN’s latest monetary statistics. The money supply increased by 4.6% m/m, increasing to N$128.8 billion after ending September at N$123.1 billion. The broad money supply for September was revised upwards marginally by approximately N$215.5 million. The BoN’s stock of international reserves rose by 4.4% m/m to N$47.9 billion in October.

Outlook

PSCE growth in October remained subdued, in line with the sluggish trend in growth that has now persisted for the best part of two years. The South African Reserve Bank’s (SARB) monetary policy committee (MPC) raised the South African Repo Rate for the first time in almost three years during its last meeting on 18 November. The rate hike came off the back of elevated inflation that threatened to rise beyond 6.0% y/y, the upper-bound of the SARB’s inflation target. While the rate hike may ease inflation concerns it will not stimulate growth in the private sector credit markets. Despite this hike, Namibia’s repo rate is now equal to the that of South Africa’s, so there is no immediate need for the BoN’s MPC to hike, however we expect them to follow suit at the 15 December meeting. Regardless, there are plenty of external forces conspiring to supress growth in private sector credit extensions and not all that many working to stimulate it. Weak growth is likely to continue in the short to medium-term.