Twitter Timeline

[custom-twitter-feeds]

Categories

- Calculators (1)

- Company Research (295)

- Capricorn Investment Group (51)

- FirstRand Namibia (53)

- Letshego Holdings Namibia (25)

- Mobile Telecommunications Limited (7)

- NamAsset (3)

- Namibia Breweries (45)

- Oryx Properties (58)

- Paratus Namibia Holdings (6)

- SBN Holdings Limited (17)

- Economic Research (660)

- BoN MPC Meetings (13)

- Budget (19)

- Building Plans (142)

- Inflation (142)

- Other (28)

- Outlook (17)

- Presentations (2)

- Private Sector Credit Extension (141)

- Tourism (7)

- Trade Statistics (4)

- Vehicle Sales (143)

- Media (25)

- Print Media (15)

- TV Interviews (9)

- Regular Research (1,797)

- Business Climate Monitor (75)

- IJG Daily (1,600)

- IJG Elephant Book (12)

- IJG Monthly (108)

- Team Commentary (250)

- Danie van Wyk (61)

- Dylan van Wyk (27)

- Eric van Zyl (16)

- Hugo van den Heever (1)

- Leon Maloney (11)

- Top of Mind (4)

- Zane Feris (12)

- Uncategorized (6)

- Valuation (4,471)

- Asset Performance (116)

- IJG All Bond Index (2,072)

- IJG Daily Valuation (1,798)

- Weekly Yield Curve (484)

Meta

Category Archives: Economic Research

PSCE – May 2022

Overall

Private sector credit (PSCE) rose by N$351.3 million or 0.3% m/m in May, the slowest month-on-month increase so far in 2022, bringing the cumulative credit outstanding to N$116.6 billion. On a year-on-year basis, private sector credit grew by 11.0% y/y in May, compared to the 10.5% y/y growth recorded in April. Normalising for the large increases in claims on non-resident private sectors recorded between January and March, sees PSCE growth at 3.9% y/y in May. On a 12-month cumulative basis N$11.6 billion worth of credit was extended to the private sector. Of this cumulative issuance, individuals took up N$1.48 billion, corporates increased their borrowings by N$3.21 billion and the non-resident private sectors took up N$6.86 billion.

Credit Extension to Individuals

Credit extended to individuals increased by 0.3% m/m and 2.4% y/y in May. Mortgage loans to individuals posted growth of 0.2% m/m and 2.4% y/y. Overdraft facilities to individuals grew by 0.4% m/m but contracted by 1.7% y/y. Other loans and advances (consisting of credit card debt, personal- and term loans) rose by 0.8% m/m and 5.2% y/y.

Credit Extension to Corporates

Credit extended to corporates grew by 7.4% y/y in May, following the 5.9% y/y increase recorded in April. On a month-on-month basis, credit extension to corporates rose 0.2% m/m in May. The growth was primarily driven by an increase in ‘other loans and advances’ of 4.5% m/m and 18.2% y/y. Instalment credit by corporates rose by 1.4% m/m and 16.6% y/y, albeit from a low base. Mortgage loans contracted by 1.2% m/m but rose 3.6% y/y, while overdrafts fell by 4.9% m/m and 5.2% y/y.

Banking Sector Liquidity

The overall liquidity position of the commercial banks rose significantly in May, rising by N$778.3 million to an average of N$3.79 billion. The BoN partly ascribed the increase to an increase in diamond sales proceeds during the month. The repo balance fell to N$438.9 million at the end of the month, after ending April at N$1.97 billion.

Reserves and Money Supply

Broad money supply (M2) rose by N$5.8 billion or 4.8% y/y to N$127.6 billion, according to the BoN’s latest monetary statistics. Foreign reserve balances rose by 2.0% m/m or N$879.2 million to a total of N$43.9 billion. The rise was attributed to revaluation gains in the form of foreign currency investments during the period.

Outlook

Although May’s PSCE growth figure was the slowest on a month-on-month basis so far this year, it was the fifth consecutive month Namibian PSCE grew. As noted earlier in this report, normalising for the large increases in claims on non-resident private sectors recorded between January and March, sees PSCE growth at 3.9% y/y in May. Overall credit demand, and the willingness of commercial banks to extend credit thus remain low. Corporate credit growth continues to be driven by up the uptake of short-term credit, whereas the growth in credit to individuals was largely driven by the uptake of mortgage loans over the last 12 months.

Building Plans – May 2022

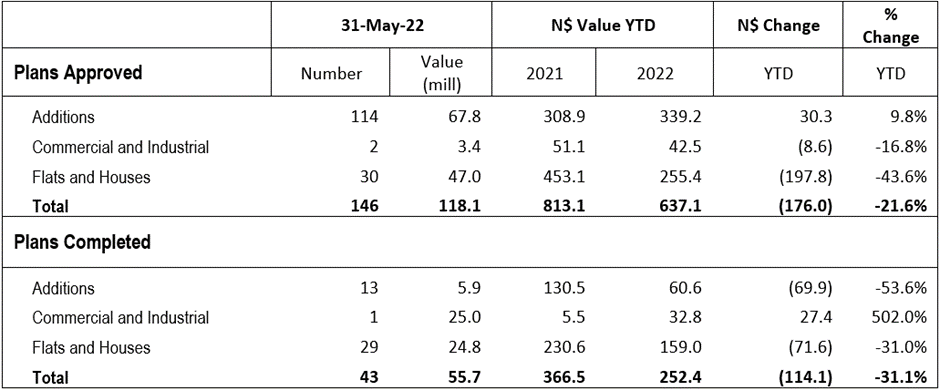

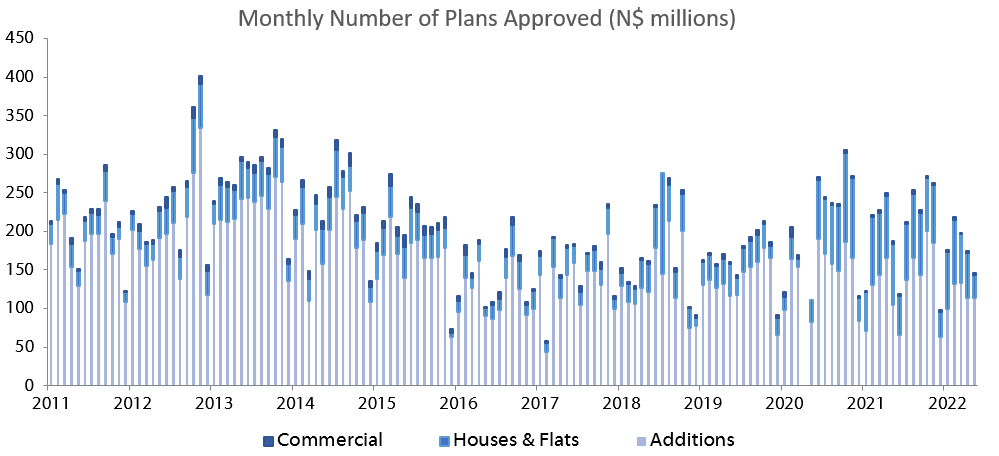

A total of 146 building plans were approved by the City of Windhoek in May, representing a 15.6% m/m decrease from the 173 building plans approved in April. In value terms, the approvals were valued at N$118.1 million, an 11.4% m/m increase from the N$106.0 million approved in April. Year-to-date 912 building plans were approved worth N$637.1 million, a 9.5% y/y decrease in the number of plans approved and a 21.6% y/y decrease in value terms. On a twelve-month cumulative basis, 2,355 buildings with a value of N$1.79 billion were approved, a 12.3% decrease in the number of plans approved and an 11.3% decrease in value terms over the prior 12-month period. 43 building plans worth N$55.7 million were completed during the month.

In terms of both the number and value of approvals, additions to properties once again made up the largest portion of approvals. For the month of May, 114 additions to properties were approved with a value of N$67.8 million, the same number of approvals recorded in April. The value of the additions approved is 7.7% higher than last month and 22.4% higher than during the same month last year. 13 Additions worth N$5.9 million were completed during the month.

New residential units were the second largest contributor to the number and value of building plans approved with 30 approvals registered in May, 28 fewer than in April. In value terms N$47.0 million worth of residential units were approved in May, a 10.1% m/m increase. On a year-on-year basis, the value of approvals is however 49.3% lower than registered in May 2021. On a 12-month cumulative basis, the number of residential units approved decreased by 17.3% y/y to 772, the lowest since February 2021. 29 New residential units worth N$24.8 million were completed in May.

2 New commercial units valued at N$3.4 million were approved in May, compared to 1 approval worth N$380,00 in April and 4 units worth N$25.0 million approved in May 2021. Year-to-date there have been 12 commercial building approvals valued at N$42.5 million, which translates to a 25.0% y/y decrease in the number of plans approved and a 16.8% y/y decrease in value terms. On a rolling 12-month perspective, the number of commercial and industrial approvals remained steady at 33 units worth N$162.8 million, compared to the 33 units approved worth N$135.3 million over the corresponding period a year ago. Only 1 commercial and industrial unit worth N$25.0 million was completed in May.

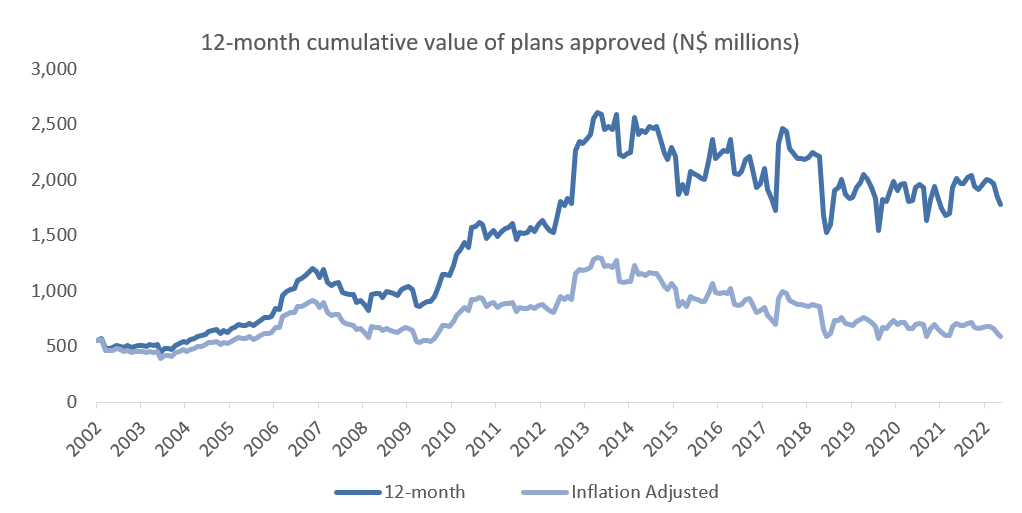

As illustrated in the figure above and below, the cumulative value of building plans approved and completed continues to trend downward in both nominal and inflation-adjusted terms. Completed building plans decreased by 34.4% y/y in value terms to N$999.7 million on a 12-month cumulative basis. A total of 2,355 building plans to the value of N$1.79 billion were approved over the last 12 months which represents a decrease in value terms of 11.3% y/y and a 12.3% y/y decrease in the number terms. Additions to properties continue to contribute the majority of the cumulative approvals at 65.8% in number terms. The 12-month cumulative number of commercial and industrial approvals remains in the single digit territory which have been the case since June 2016, indicating a dearth of investment by enterprises. Building plans approved is a leading indicator of economic activity in the country and the above data implies that the Namibian economy is still showing signs of hardship.