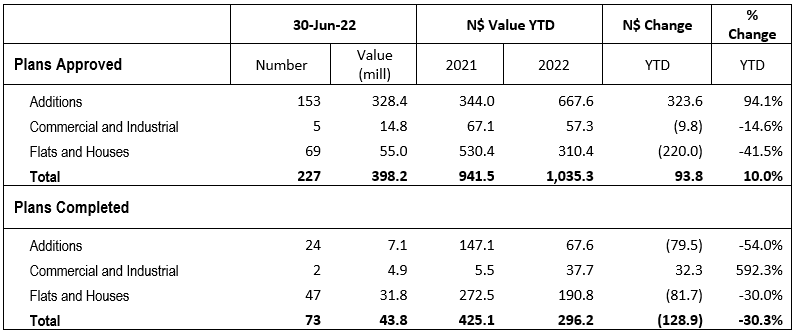

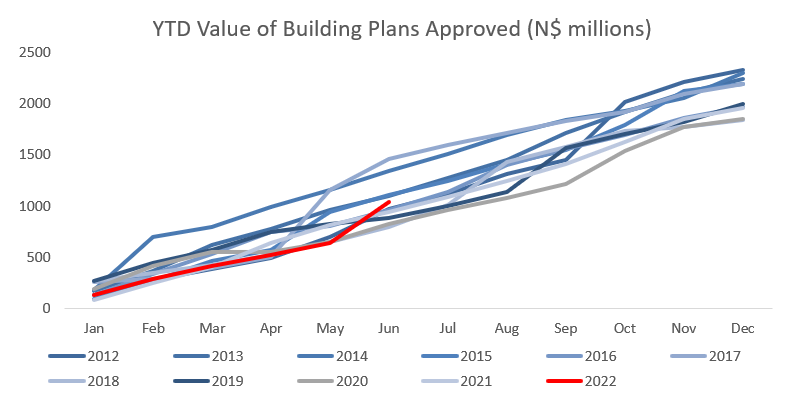

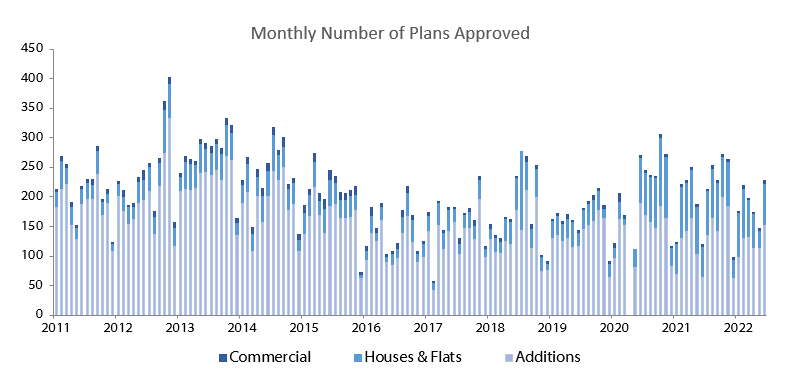

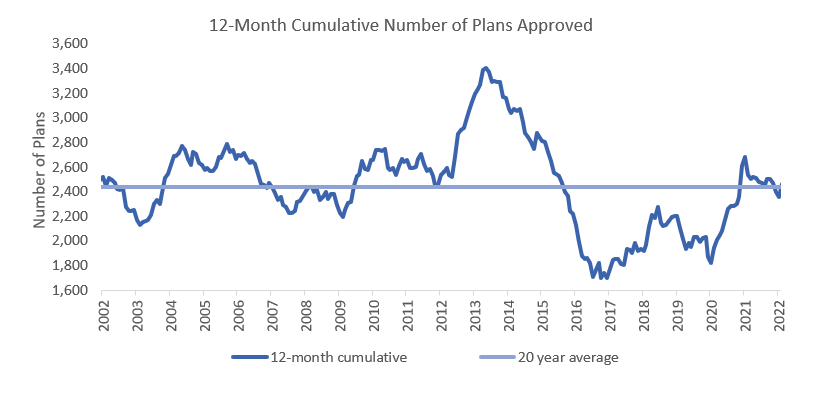

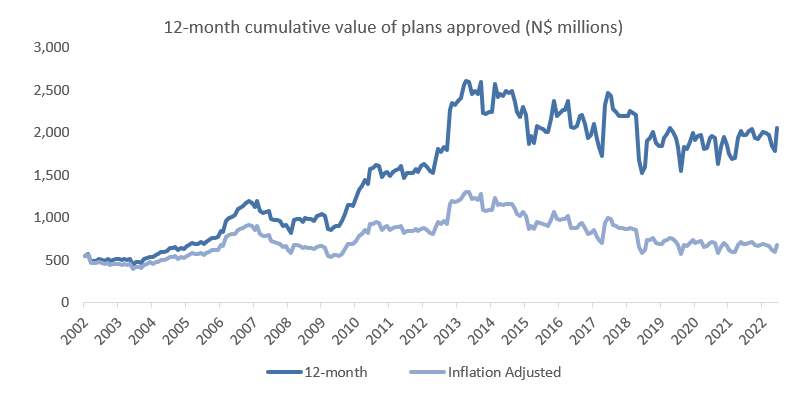

The City of Windhoek approved a total of 227 building plans in June, representing a 55.5% m/m increase from the 146 building plans approved in May. In value terms, the approvals were valued at N$398.2 million, a 237.2% m/m increase from the N$118.1 million approved in May. Year-to-date 1,139 building plans were approved worth N$1.03 billion, a 1.1% y/y increase in the number of plans approved, and a 10% y/y increase in value terms. On a twelve-month cumulative basis, 2,463 buildings with a value of N$2.05 billion were approved, a 2.8% decrease in the number of plans approved but a 4.4% increase in value terms over the prior 12-month period. 73 building plans worth N$43.8 million were completed during the month.

Additions to properties once again made up the largest portion of the building plans approved both in terms of the number and the value of plans approved. For the month of June, 153 additions to properties were approved valued at N$328.4 million, the largest single month approval in value terms ever recorded. The value of the additions approved is 384.5% higher than last month and 835.1% higher than during the same month last year. It is however worth pointing out that the high value in additions recorded in June stems from a single property. If excluded, the value of additions in June amounts to N$48.2 million, representing a 29% m/m decline from the N$67.8 million worth of additions approved in May and a 37% increase compared to June last year. 24 Additions worth N$7.07 million were completed during June, a 19.6% m/m increase in terms of the value of additions completed.

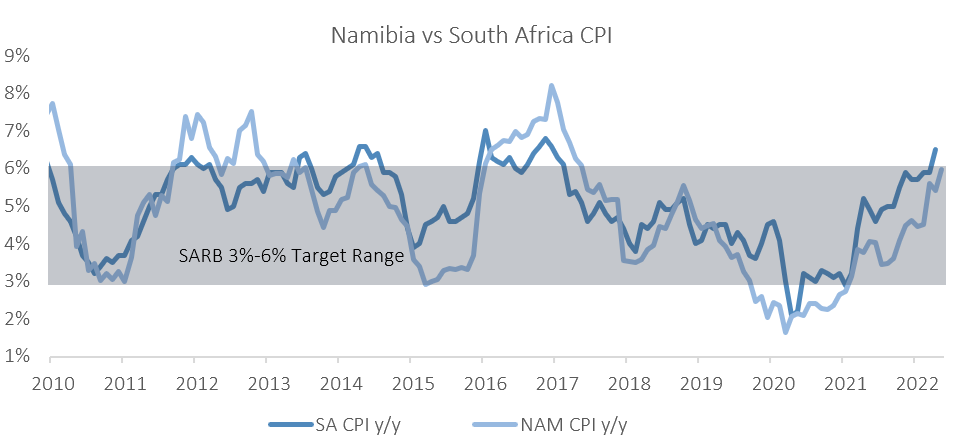

New residential units were the second largest contributor to the number and value of building plans approved with 69 approvals registered in June compared to 30 in May. In value terms N$55.0 million worth of residential units were approved in June, a 17.1% m/m increase. On a year-on-year basis, the value of approvals is however 28.8% lower than registered in June last year. On a 12-month cumulative basis, the number of residential units approved decreased by 13% y/y to 790. Further declines in these numbers are expected given the current inflationary environment and the resultant rise in building costs which makes building new residential properties less affordable when compared to existing properties in the market. 47 New residential units worth N$31.8 million were completed during June, a 28.4% m/m increase in terms of the value of the residential units completed.

5 New commercial units valued at N$14.8 million were approved in June, compared to 2 units worth N$3.35 million approved in May and 3 units worth N$16.0 million approved in June 2021. Year-to-date there have been 17 commercial building approvals valued at N$57.3 million, which translates to a 10.5% y/y decrease in the number of plans approved and a 14.6% y/y decrease in value terms. On a rolling 12-month perspective, the number of commercial and industrial approvals remained steady at 33 units worth N$161.6 million, compared to the 32 units approved worth N$146.1 million over the corresponding period a year ago. 2 Commercial and industrial units worth N$4.9 million were completed in June.

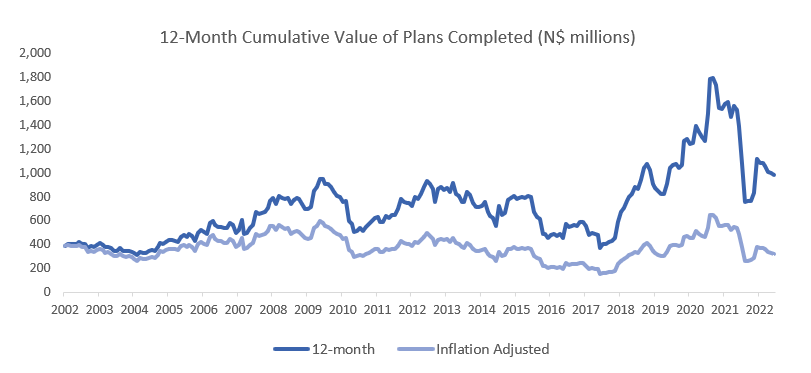

Approved building plans increased by 4.4% y/y in value terms to N$2.05 billion on a 12-month cumulative basis. The improvement in the cumulative value of building plans observed in June is however mainly due to a single addition worth over N$280 million as mentioned earlier – it is unlikely that the value of approvals seen in June will be sustained in the foreseeable months. Therefore, tapering in the 12-month cumulative value of building plan approvals is expected over the ensuing months. Building plans completed continue to trend downward in both nominal and inflation-adjusted terms as illustrated below. Completed building plans decreased by 29.2% y/y in value terms to N$984.9 million on a 12-month cumulative basis. Given that building plan approvals is a leading indicator of economic activity in the country, the data above, bar the single significant addition mentioned, implies that Namibian’s economy is still enduring tough times.