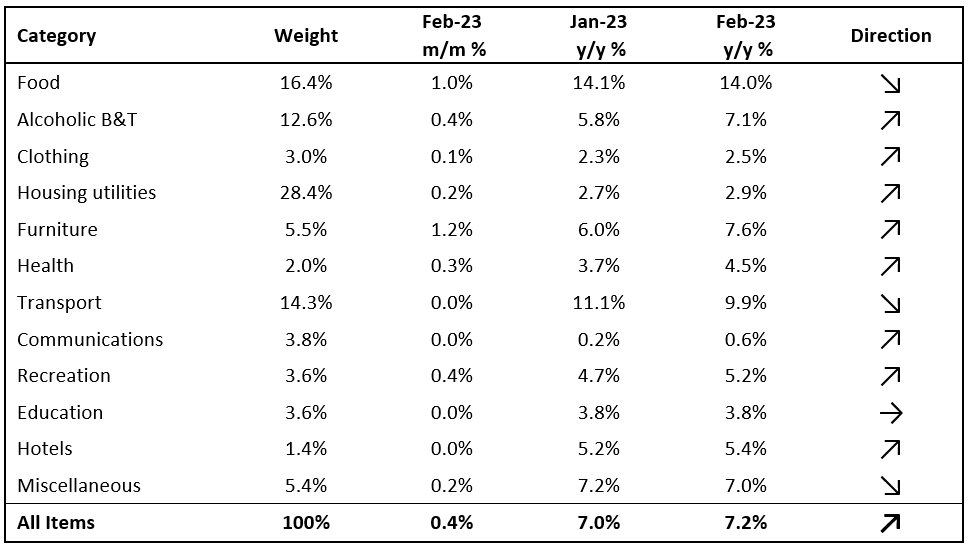

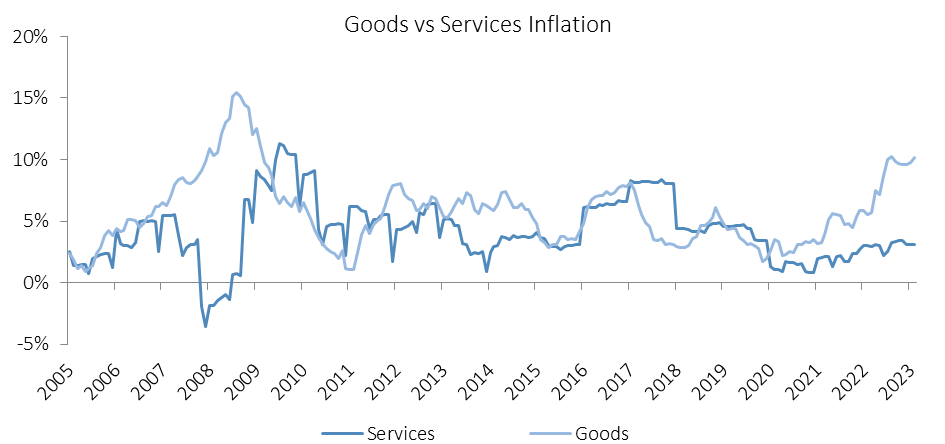

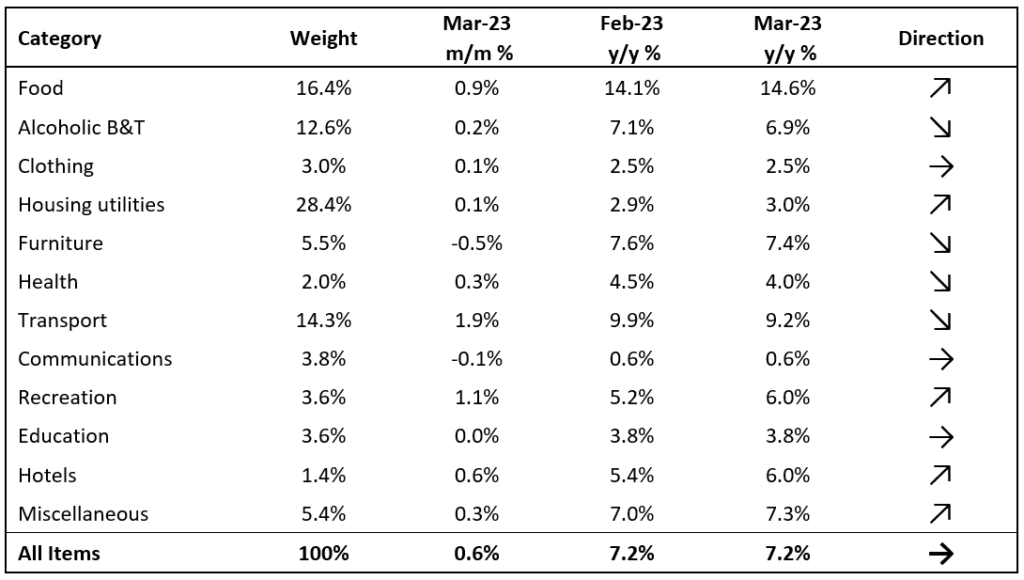

Namibia’s annual inflation rate remained unchanged at 7.2% y/y in March. On a month-on-month basis, prices in the overall NCPI basket rose by 0.6%, compared to a 0.4% m/m increase in February. On an annual basis, overall prices in five of the twelve basket categories rose at a quicker rate in March than in February, four categories recorded slower rates of inflation and three recorded inflation rates consistent with those in February. Inflation on goods and services remained steady at 10.1% y/y and 3.1% y/y, respectively.

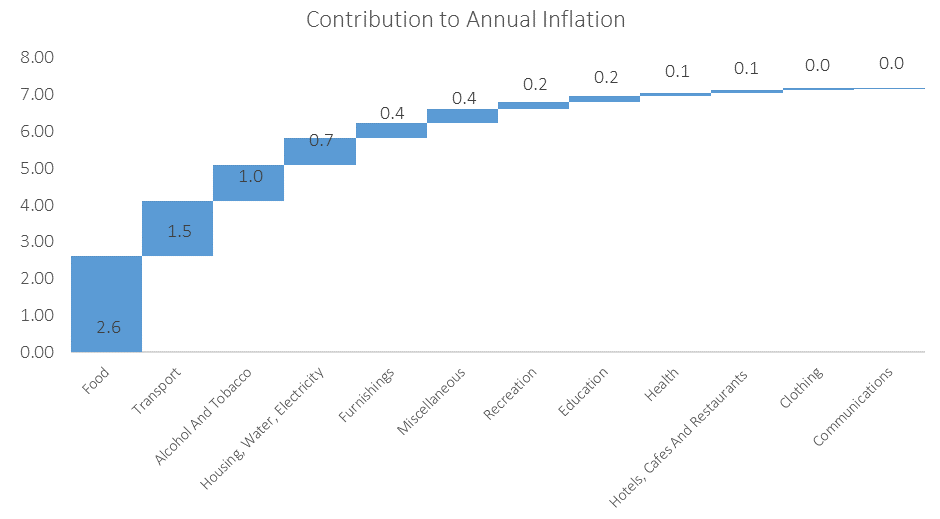

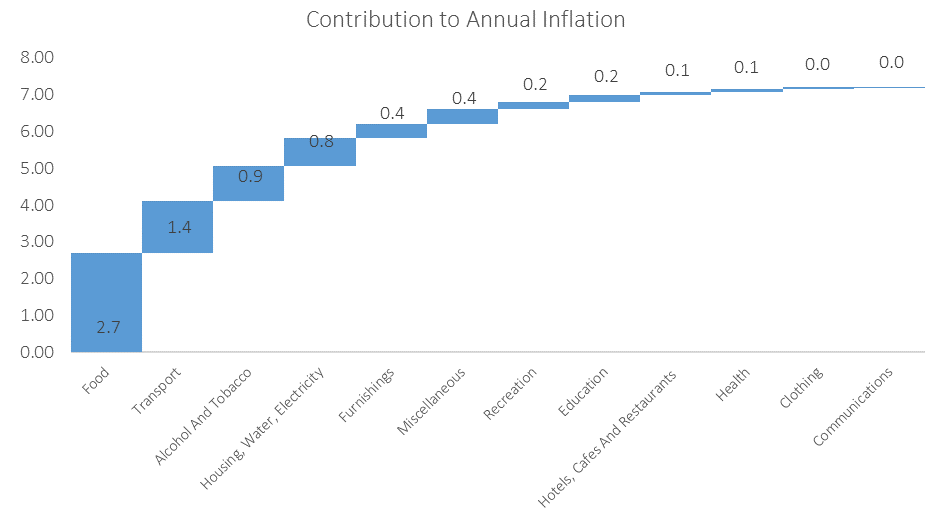

Food and non-alcoholic beverages remain the largest contributor to inflation, contributing 2.7 percentage points to March’s annual inflation print. Food and non-alcoholic beverage prices rose by 0.9% m/m and 14.6% y/y, the highest annual inflation print for this category since March 2009. Most of the sub-categories in this basket item posted higher annual inflation compared to February. Fruit again posted the highest inflation print of all the sub-categories. Fruit prices rose by 1.4% m/m and 29.1% y/y. Breads and cereals were the only sub-category registering slowing inflation. Prices in this sub-category, however, remained elevated after rising by 0.9% m/m and 20.8% y/y in March.

Transport was the second largest contributor to the annual inflation print in March, contributing 1.4 percentage points. Prices in this basket category rose by 1.9% m/m and by 9.2% y/y in March. Operation of personal transport equipment inflation continued to decelerate with prices in this sub-category rising by 12.5% y/y compared to 14.2% y/y in February. The Ministry of Mines and Energy’s decision to leave the price of petrol and diesel unchanged for April means we could see the trend continue into next month’s inflation print. Purchase of vehicles inflation accelerated. Prices in this subcategory rose by 1.1% m/m while annual inflation increased to 6.0% from 5.3% in February. Public transportation services inflation decelerated slightly to 1.0% y/y from 1.1% y/y a month earlier while prices remained steady month-on-month.

As the graph above shows, the largest contributor to inflation among the remaining categories was the alcohol and tobacco basket item. Prices in this category rose by 0.2% m/m and 6.9% y/y in March compared to increases of 0.4% m/m and 7.1% y/y in February. Both alcohol and tobacco sub-categories posted slightly slower rates of inflation. Alcoholic beverage inflation slowed to 7.4% y/y from 7.6% y/y in February. White spirits continue to be a notable driver of inflation pressure in this sub-category with annual inflation on white spirits accelerating for the fourth consecutive month to 28.3% from 26.0% a month ago. Tobacco products inflation slowed to 4.8% y/y from 5.1% in February. Inflation on cigarettes remained steady at 5.8% y/y while pipe tobacco inflation slowed to 1.8% y/y from 2.9% y/y. in February. As noted in last months’ NCPI report, we anticipate more price pressures to come from this sub-category following the announcement of a steep rise in “sin taxes” on alcoholic beverages and tobacco products during February’s annual budget speech.

Outlook

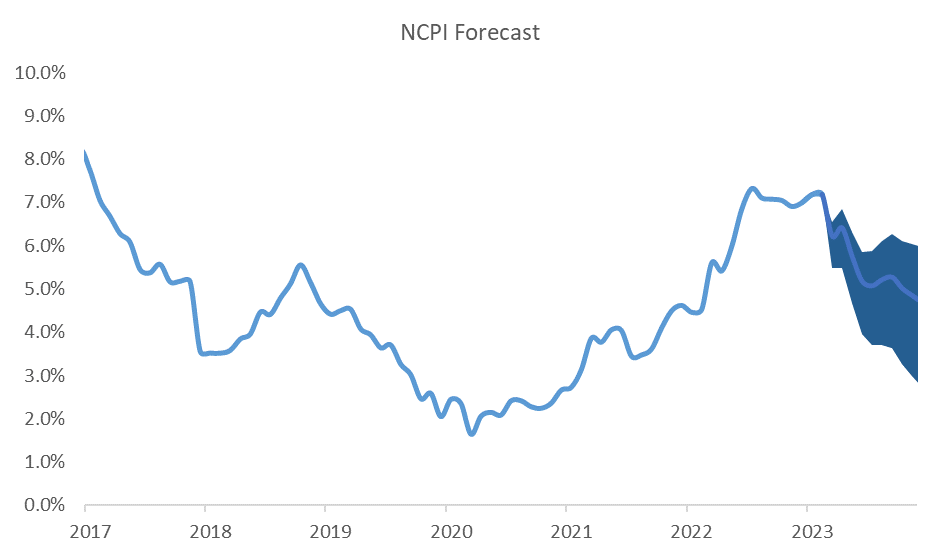

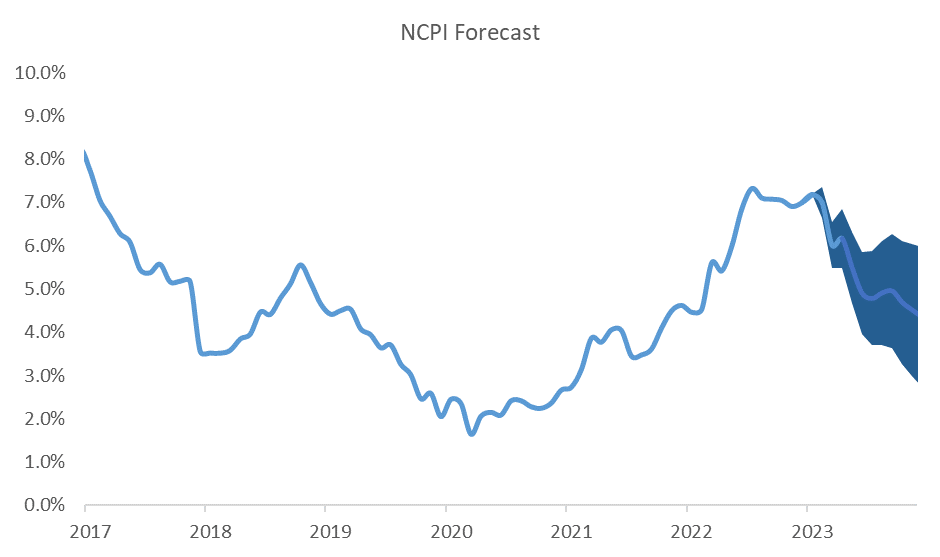

March’s sticky inflation print of 7.2% comes as a surprise given that we expected some easing like we have seen from recent CPI prints in other parts of the world. This means that the much-anticipated disinflationary cycle has yet to come into effect, setting the stage for a prolonged restrictive monetary policy stance as was alluded to during last month’s report.

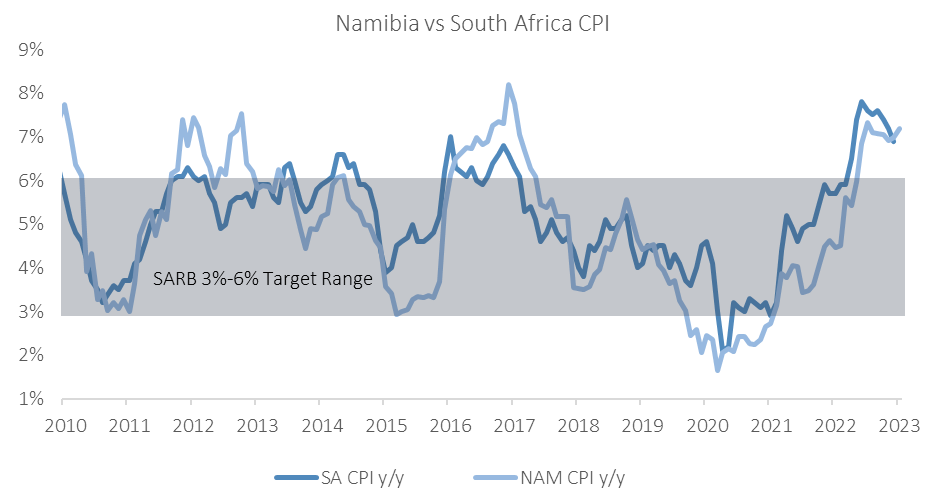

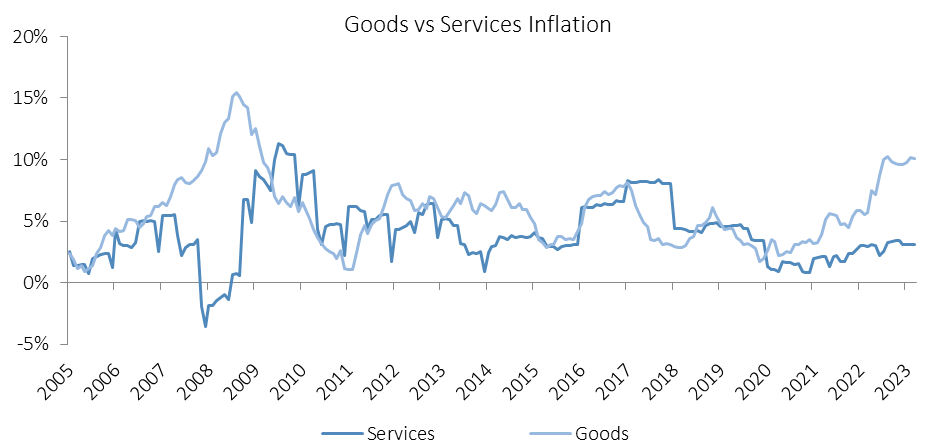

The SARB raised its lending rate by a further 50bps in March, implying that its monetary policy committee is of the view that more needs to be done in terms of curbing inflation and bringing it within the target range. The Bank of Namibian (BoN) will almost certainly respond in kind when it holds its MPC meeting on 19 April. Namibia’s inflation has been trending slightly higher than South Africa’s in recent months as the graph above shows and this trend will also be on the radar of the BoN’s MPC when it decides on the extent of further tightening required to keep price stability and the currency peg in check.

IJG’s inflation model continue to predict a gradual slowdown in Namibia’s annual inflation rate over the remainder of year, before ending the year at around 4.8%.