Twitter Timeline

[custom-twitter-feeds]

Categories

- Calculators (1)

- Company Research (295)

- Capricorn Investment Group (51)

- FirstRand Namibia (53)

- Letshego Holdings Namibia (25)

- Mobile Telecommunications Limited (7)

- NamAsset (3)

- Namibia Breweries (45)

- Oryx Properties (58)

- Paratus Namibia Holdings (6)

- SBN Holdings Limited (17)

- Economic Research (660)

- BoN MPC Meetings (13)

- Budget (19)

- Building Plans (142)

- Inflation (142)

- Other (28)

- Outlook (17)

- Presentations (2)

- Private Sector Credit Extension (141)

- Tourism (7)

- Trade Statistics (4)

- Vehicle Sales (143)

- Media (25)

- Print Media (15)

- TV Interviews (9)

- Regular Research (1,799)

- Business Climate Monitor (75)

- IJG Daily (1,602)

- IJG Elephant Book (12)

- IJG Monthly (108)

- Team Commentary (250)

- Danie van Wyk (61)

- Dylan van Wyk (27)

- Eric van Zyl (16)

- Hugo van den Heever (1)

- Leon Maloney (11)

- Top of Mind (4)

- Zane Feris (12)

- Uncategorized (6)

- Valuation (4,475)

- Asset Performance (116)

- IJG All Bond Index (2,074)

- IJG Daily Valuation (1,800)

- Weekly Yield Curve (484)

Meta

Category Archives: Economic Research

PSCE – May 2023

Overall

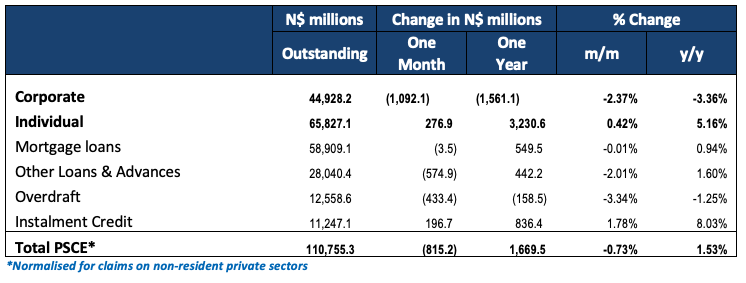

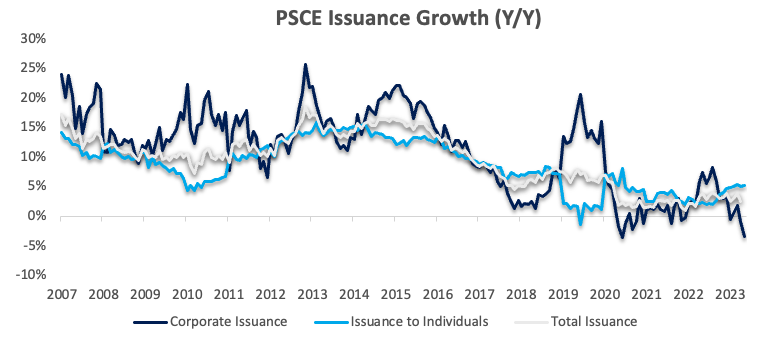

Private sector credit (PSCE) fell by N$815.2 million or 0.73% m/m in May, bringing the cumulative credit outstanding to N$110.8 billion on a normalised basis (removing the interbank swaps the Bank of Namibia (BoN) accounts for in non-resident private sector claims). Annual PSCE growth slowed to 1.53% in May from 2.57% in April. N$1.67 billion worth of credit was extended to the private sector over the past twelve months, 59.0% less than the N$4.08 billion issued over the same period a year ago. Individuals took up N$3.23 billion worth of credit over this period, while corporates deleveraged by N$1.56 billion.

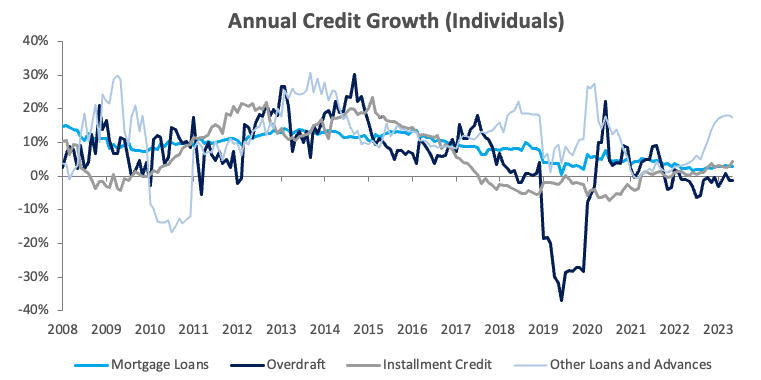

Credit Extension to Individuals

Credit extended to individuals rose by 0.4% m/m and 5.16% y/y. As was the case in April, all sub-categories, bar overdrafts, posted growth on a year-on-year basis. Mortgage loans attributed to most of the credit uptake by individuals during the month, with the sub-category recording growth of 0.2% m/m and 2.8% y/y. Instalment credit extended to individuals increased by 1.6% m/m and 4.4% y/y in May. ‘Other loans and advances’, which is made up of credit card debt and personal- and term loans, grew by 0.5% m/m and 17.5% y/y, while overdraft facilities to individuals increased by 0.3% m/m but fell 1.3% y/y.

Credit Extension to Corporates

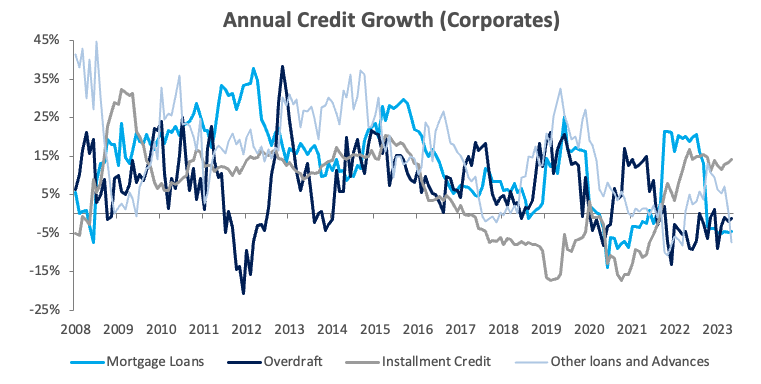

The month-on-month PSCE contraction was primarily due to corporates deleveraging their balance sheets. Credit extension to corporates fell by 2.4% m/m and 3.4% y/y as all sub-categories, bar instalment credit, fell on both a month-on-month and year-on-year basis. ‘Other loans and advances’ declined by 3.7% m/m and 7.5% y/y. Overdraft facilities to corporates contracted by 4.2% m/m and 1.2% y/y, while mortgage loans fell by 0.8% m/m and 4.5% y/y. Instalment credit to corporates rose by 2.1% m/m and 14.1% y/y.

Banking Sector Liquidity

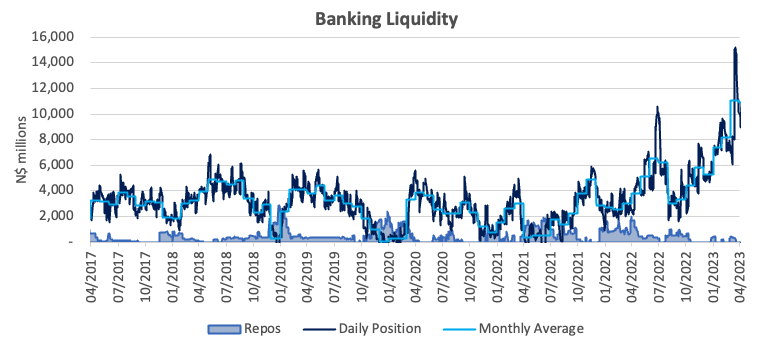

The overall liquidity position of the commercial banks remained strong during May, declining by N$150.9 million to an average of N$10.9 billion. According to the Bank of Namibia (BoN) the small decline was due to corporates gearing up for corporate tax payments and partial outflows of funds received from the Heineken-Namibia Breweries transactions. The repo balance was unsurprisingly near zero for most of the month.

Money Supply and Reserves

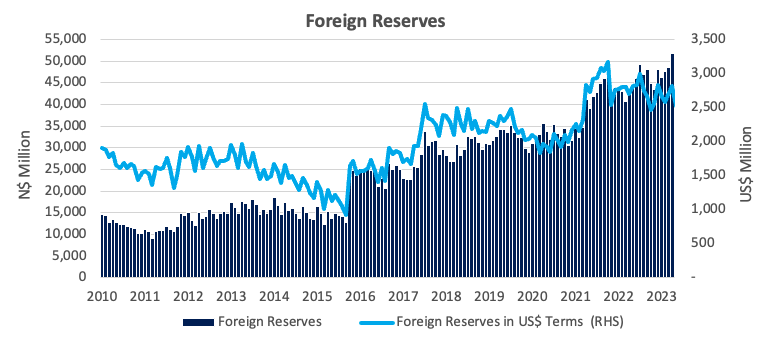

According to the BoN’s latest monetary statistics, broad money supply (M2) rose by N$9.83 billion or 7.7% y/y in May. The stock of international reserves fell by 4.0% m/m or N$2.07 billion to N$49.7 billion, translating to 5.2 months of import cover. The BoN ascribed the decline to net commercial bank outflows due to “portfolio investment and import payments”.

Outlook

The annual PSCE growth rate slowed to the lowest level since December 2021 in May. As mentioned earlier in the report, the growth slowdown, and month-on-month contraction, was primarily due to corporates continuing to delever their balance sheets, amid rising interest rates. Credit extension to individuals is stronger, by comparison, but continues to trend well below inflation. While central bank rhetoric in both Namibia and South Africa remains hawkish, we do not anticipate overall PSCE growth to pick up materially in the short- to medium term.

Building Plans – May 2023

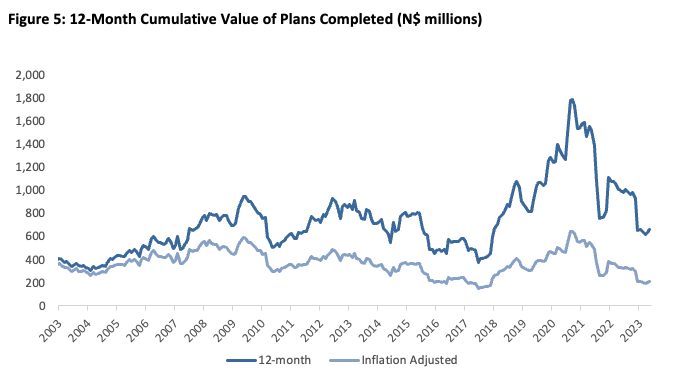

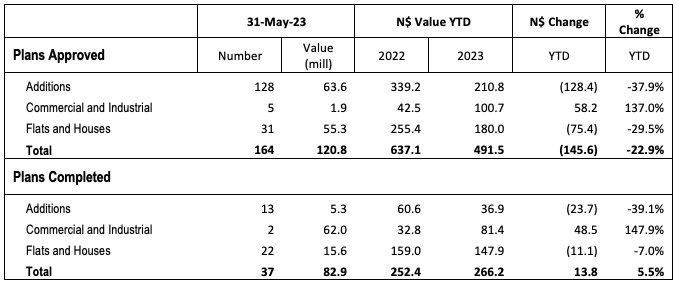

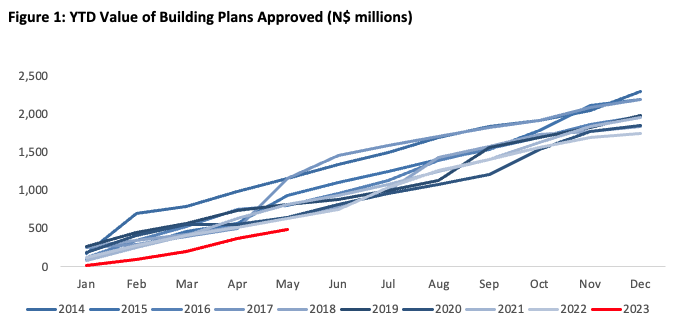

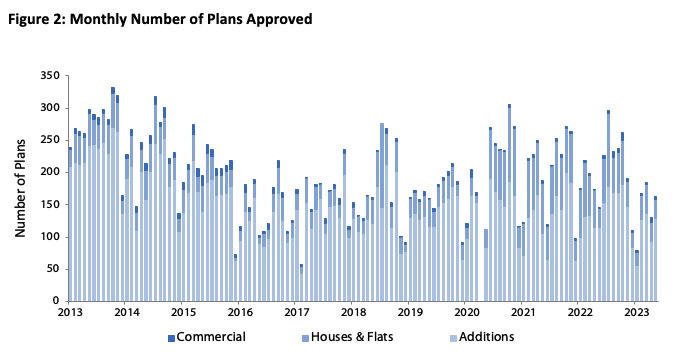

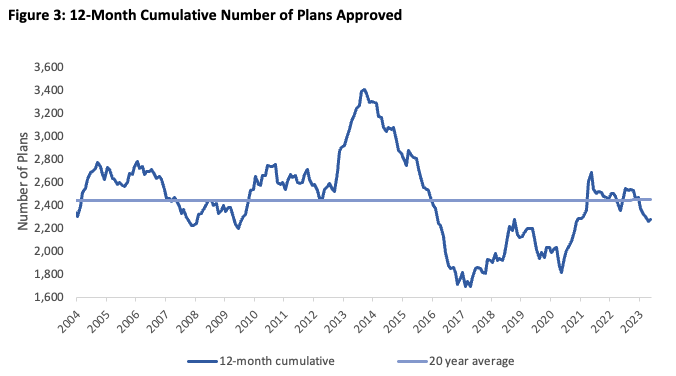

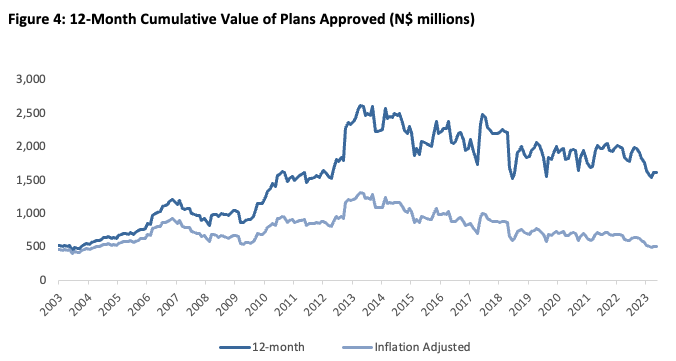

A total of 164 building plans was approved by the City of Windhoek in May, representing a 25.2% m/m increase from the 131 building plans approved in April. The approvals were valued at N$121.0 million, a 30.4% m/m drop from the N$173.4 million approved in April. Year-to-date, 725 building plans worth N$491.5 million have been approved, down 20.5% in number terms and 22.9% y/y less in value terms compared to the same period in 2022. On a twelve-month cumulative basis, 2,280 buildings worth N$1.61 billion were approved, a contraction of 3.2% y/y in number- and 10.0% y/y in value terms. 37 building plans worth N$82.9 million were completed during May.

May saw 128 additions to properties approved worth N$63.6 million. This figure represents the highest monthly value of approvals witnessed thus far in 2023. Year-to-date, 540 additions to properties worth N$210.8 million have been approved, representing an 8.8% drop in number terms and a 37.9% contraction in value terms compared to the corresponding period in 2022. On a 12-month cumulative basis, 1,623 additions worth N$758.3 million were approved over the past 12 months, compared to 1,550 additions worth N$783.2 million over the same period a year ago. 13additions worth N$5.32 million were completed during May, which falls below the average monthly additions completed so far this year.

A total of 31 new residential units valued at N$55.3 million were approved in May, exceeding the average monthly count of newly approved residential properties thus far this year. Moreover, May witnessed the highest residential approval value since November 2022. The 12-month cumulative new residential unit approval figure remained steady at 589, following 10 consecutive months of contraction. Year-to-date, 163 new residential units worth N$180.0 million have been approved, down 47.4% from the 308 units worth N$255.4 million approved over the same period a year ago. A total of 22 residential units valued at N$15.58 million were completed during May, marking the lowest residential completion figure observed year to date.

5 new commercial and industrial units worth N$1.92 million were approved in May. This brings 2023’s monthly average approvals to about 5 units worth N$20.2 million, up from N$13.6 million approved on average each month in 2022, but still well below the monthly average witnessed just prior to the pandemic, when N$45.9 million worth of units were approved on average each month in the 3 years leading up to the pandemic. 22 new commercial and industrial units valued at N$100.7 million have been approved year-to-date, an increase of 137.0% y/y in value terms. This increase is however mostly due to the relatively large N$76.7 million approval amount registered last month. On a rolling 12-month cumulative basis, 67 commercial and industrial units valued at N$221.1 million have been approved at the end of May, compared to 33 units worth N$162.8 million over the same period a year ago. 2 commercial and industrial units worth N$62.0 million were completed in May.

While May’s building plan approvals data was one of the better months so far this year, overall planned activity remains weak. 2023 is off to the slowest start in value terms since 2009, even before accounting for inflation.

According to the Q1 GDP data released by the Namibian Statistics Agency (NSA) in May, the construction sector recorded marginal quarter-on-quarter growth of 0.9% in real terms during the quarter of 2023. This growth comes after the sector had encountered six consecutive quarterly contractions. The NSA attributed the growth to a 13.2% increase in government construction spending during the quarter. The 12-month cumulative value of approvals has consistently been trending down in real terms for most part of the last decade, as the graph above shows.