Twitter Timeline

[custom-twitter-feeds]

Categories

- Calculators (1)

- Company Research (295)

- Capricorn Investment Group (51)

- FirstRand Namibia (53)

- Letshego Holdings Namibia (25)

- Mobile Telecommunications Limited (7)

- NamAsset (3)

- Namibia Breweries (45)

- Oryx Properties (58)

- Paratus Namibia Holdings (6)

- SBN Holdings Limited (17)

- Economic Research (659)

- BoN MPC Meetings (13)

- Budget (19)

- Building Plans (142)

- Inflation (142)

- Other (28)

- Outlook (17)

- Presentations (2)

- Private Sector Credit Extension (140)

- Tourism (7)

- Trade Statistics (4)

- Vehicle Sales (143)

- Media (25)

- Print Media (15)

- TV Interviews (9)

- Regular Research (1,791)

- Business Climate Monitor (75)

- IJG Daily (1,594)

- IJG Elephant Book (12)

- IJG Monthly (108)

- Team Commentary (250)

- Danie van Wyk (61)

- Dylan van Wyk (27)

- Eric van Zyl (16)

- Hugo van den Heever (1)

- Leon Maloney (11)

- Top of Mind (4)

- Zane Feris (12)

- Uncategorized (6)

- Valuation (4,452)

- Asset Performance (115)

- IJG All Bond Index (2,062)

- IJG Daily Valuation (1,792)

- Weekly Yield Curve (482)

Meta

Category Archives: Economic Research

Building Plans – May 2019

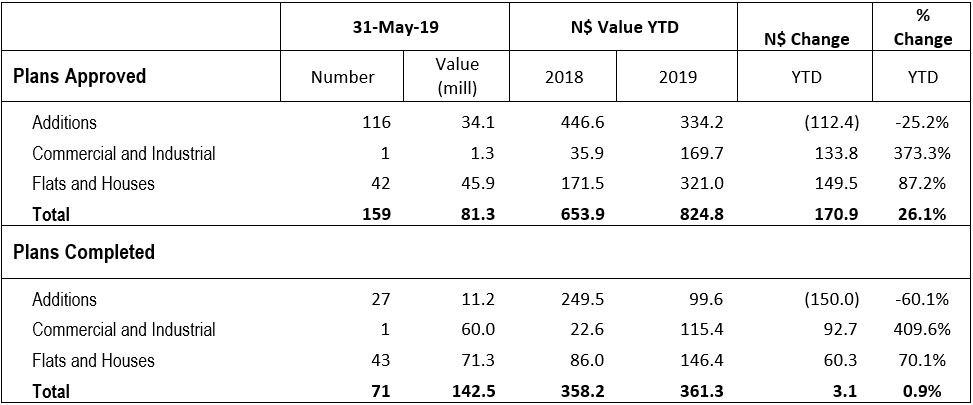

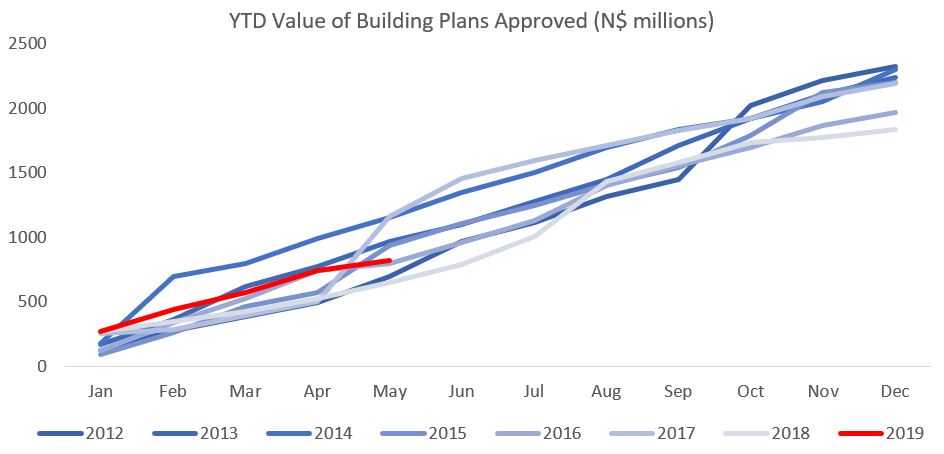

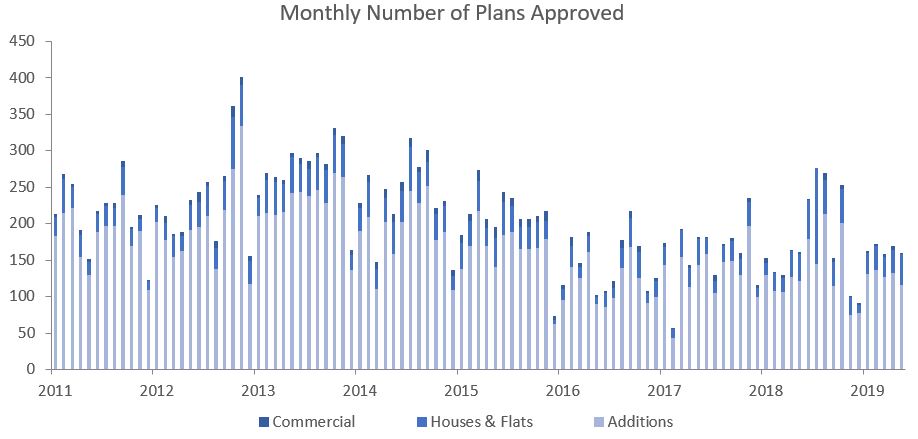

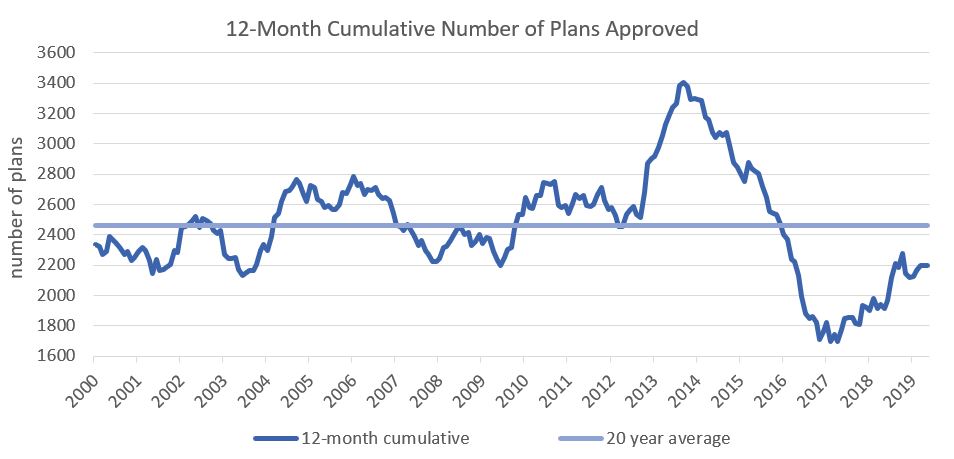

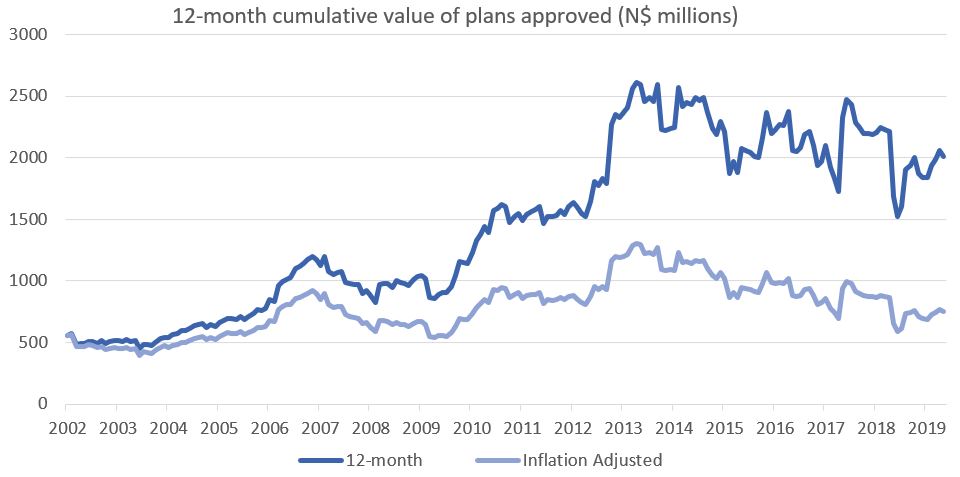

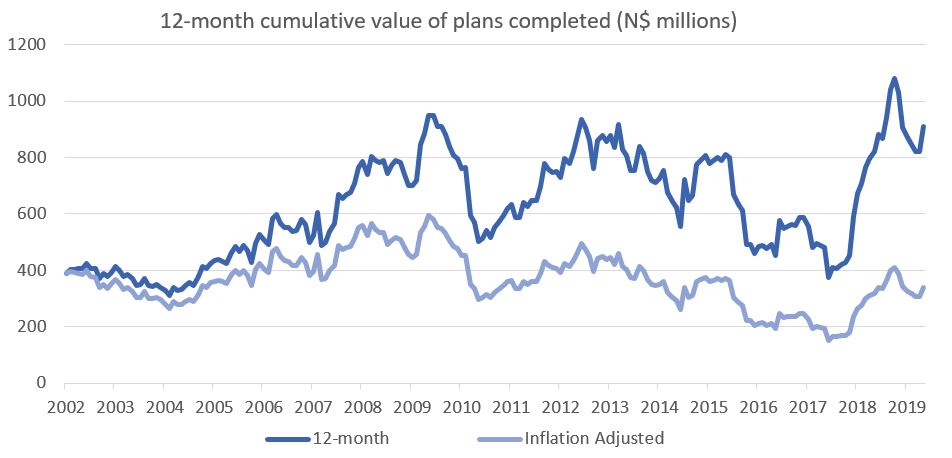

A total of 159 building plans were approved by the City of Windhoek in May, 11 less than in April. N$81.3 million worth of plans were approved in May as opposed to N$169.0 million in April. A total of 71 building plans were completed during the month with a value of N$142.5 million. Year-to-date, N$824.8 million worth of building plans have been approved, 26.1% more in value than during the corresponding period in 2018. On a twelve-month cumulative basis, 2,198 building plans have been approved worth approximately N$2.01 billion, 19.4% higher in value terms than cumulative approvals in May 2018.

116 additions to properties were approved in May with a value of N$34.1 million, a drop of 42.5% m/m and 54.5% y/y. Year-to-date 643 additions to properties have been approved with a total value of N$334.2 million, an increase of 8.8% y/y in number but a decrease of 25.2% y/y in value terms. On a 12-month cumulative basis the number of additions approved has increased by 4.4% y/y while declining by 29.7% y/y in value terms. We are seeing more additions to properties being approved but with a lower overall value being added. Year-to-date 175 additions have been completed with a combined value of N$99.6 million, down 78.9% y/y in number and 60.1% y/y in value terms.

New residential units accounted for 42 of the approvals registered in May, an increase of 31.3% m/m and 13.5% y/y. In value terms, N$45.9 million worth of residential units were approved in May, up 36.0% m/m but down 7.7% y/y. Year-to-date residential unit approvals have increased by 22.6% y/y in number and 87.2% y/y in value. On a 12-month cumulative basis the rebound in residential units has been even more impressive, recording a 77.7% y/y increase in number of approvals and a 98.6% y/y increase in value. While the magnitude of the growth in number and value of approvals is largely due to base effects it is worth noting that, in value terms, one would have to go back to early 2014 to find a higher value for approvals of flats and houses, not adjusting for inflation. As building plan approvals are a leading indicator it points to increasing construction activity going forward, albeit in the residential space.

Only 1 new commercial unit, valued at N$1.3 million, was approved in May, bringing the year-to-date number of commercial and industrial approvals to 15, worth a total of N$169.7 million. This is 11.8% down in number from May last year, but 373.3% up in value terms. On a rolling 12-month basis the number of commercial and industrial approvals have slowed to 41 units worth N$514.1 million as at May. This is a decrease of 19.6% y/y in number but an increase of 182.7% y/y in value. Unlike the strong performance seen in residential approvals, the performance in value terms over last year in the commercial and industrial space is attributable to base effects. In nominal terms the value of commercial and industrial approvals is still less on a rolling 12-month basis than in any year after 2011. The value of industrial and commercial developments is thus also picking up when compared to last May last year.

In the last 12 months 2,198 building plans worth N$2.01 billion have been approved, increasing by 14.7% y/y in terms of number of approvals and 19.4% y/y in terms of value. The total value of plans approved is 22.9% down from the peak in March 2013, as seen in the above figure. Should we adjust this figure for inflation we see that the value of plans approved is down over 42% from the peak in April 2013. Thus, while cumulative approvals have been increasing in number and value terms when compared to a year ago, construction activity in the Windhoek municipal area is very much subdued by historical standards.