Twitter Timeline

[custom-twitter-feeds]

Categories

- Calculators (1)

- Company Research (295)

- Capricorn Investment Group (51)

- FirstRand Namibia (53)

- Letshego Holdings Namibia (25)

- Mobile Telecommunications Limited (7)

- NamAsset (3)

- Namibia Breweries (45)

- Oryx Properties (58)

- Paratus Namibia Holdings (6)

- SBN Holdings Limited (17)

- Economic Research (659)

- BoN MPC Meetings (13)

- Budget (19)

- Building Plans (142)

- Inflation (142)

- Other (28)

- Outlook (17)

- Presentations (2)

- Private Sector Credit Extension (140)

- Tourism (7)

- Trade Statistics (4)

- Vehicle Sales (143)

- Media (25)

- Print Media (15)

- TV Interviews (9)

- Regular Research (1,791)

- Business Climate Monitor (75)

- IJG Daily (1,594)

- IJG Elephant Book (12)

- IJG Monthly (108)

- Team Commentary (250)

- Danie van Wyk (61)

- Dylan van Wyk (27)

- Eric van Zyl (16)

- Hugo van den Heever (1)

- Leon Maloney (11)

- Top of Mind (4)

- Zane Feris (12)

- Uncategorized (6)

- Valuation (4,452)

- Asset Performance (115)

- IJG All Bond Index (2,062)

- IJG Daily Valuation (1,792)

- Weekly Yield Curve (482)

Meta

Category Archives: Economic Research

PSCE – February 2020

Overall

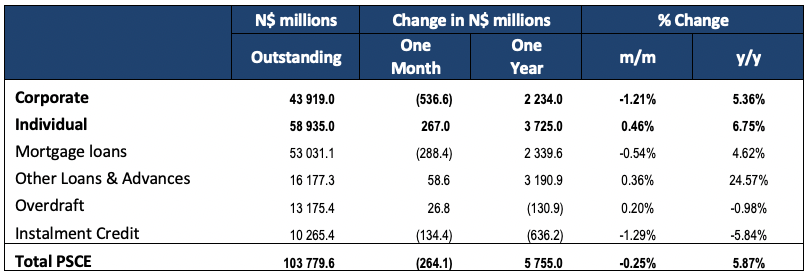

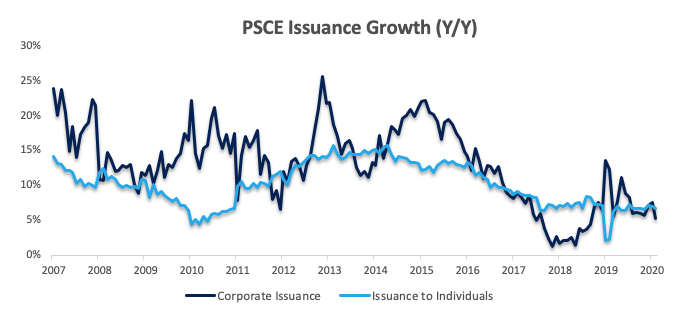

Private sector credit (PSCE) decreased by N$264.0 million or 0.25% m/m in February, bringing the cumulative credit outstanding to N$103.8 billion. On a year-on-year basis, private sector credit extension increased by 5.87% in February, compared to 6.96% y/y in January. On a rolling 12-month basis, N$5.76 billion worth of credit was extended to the private sector. Of this cumulative issuance, individuals took up credit worth N$3.73 billion, while N$2.23 billion was issued to corporates. The non-resident private sector decreased their borrowings by N$204.0 million.

Credit Extension to Individuals

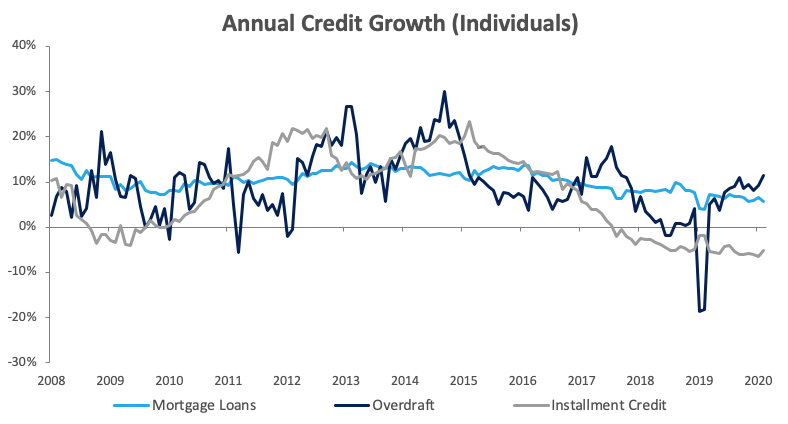

Credit extended to individuals increased by 6.7% y/y in February, growing at a slightly slower pace than the 7.0% y/y increase recorded in January. On a monthly basis, household credit grew by 0.5% following the decrease of 4.4% m/m recorded in January. Household demand for overdraft facilities was relatively strong in February, increasing by 2.7% m/m and 11.4% y/y, compared to the 18.1% m/m decline and 9.2% y/y increase seen in January. The value of mortgage loans extended to individuals fell by 0.1% m/m, but rose 5.7% y/y. Installment credit remained depressed, increasing by 0.9% m/m, but contracting by 5.1% y/y.

Credit Extension to Corporates

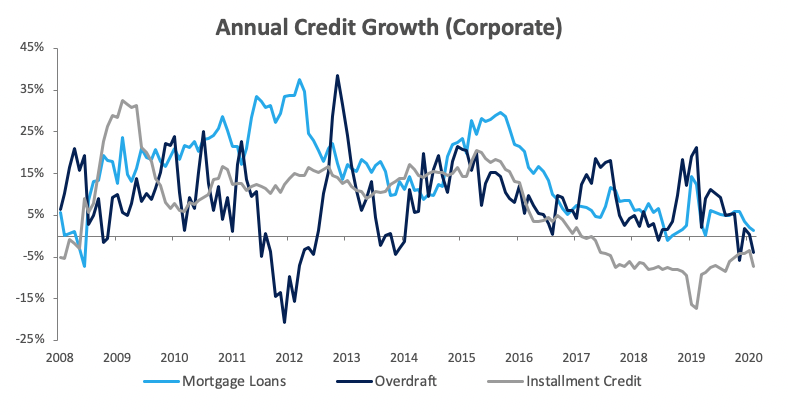

Credit extension to corporates contracted by 1.2% m/m after increasing by 7.3% m/m in January. On an annual basis, however, credit extension to corporates increased by 5.4% y/y in February, compared to the 7.5% y/y growth registered in January. The Bank of Namibia (BoN) attributed the monthly contraction to repayments made by corporates, especially those operating in the services, construction and fishing sectors. Overdraft facilities extended to corporates declined by 0.5% m/m and 3.9% y/y. Mortgage loans to corporates decreased by 1.9% m/m, but rose 1.4% y/y. Installment credit extended to corporates, which has been contracting since February 2017 on an annual basis, remained depressed, contracting by 5.1% m/m and 7.2% y/y in February. Leasing transactions to corporates fell by 4.9% m/m and 7.2% y/y.

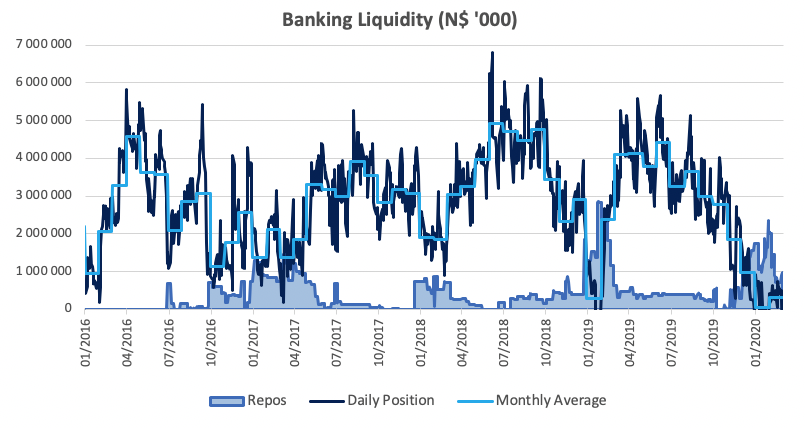

Banking Sector Liquidity

The overall liquidity position of commercial banks improved somewhat during February, increasing by N$278.2 million to reach an average of N$325.9 million. Commercial banks continued to utilize the BoN’s repo facility, as the overall liquidity position remained low. The balance of repo’s outstanding decreased from N$2.04 billion at the start of February to N$974.1 million at the end of the month.

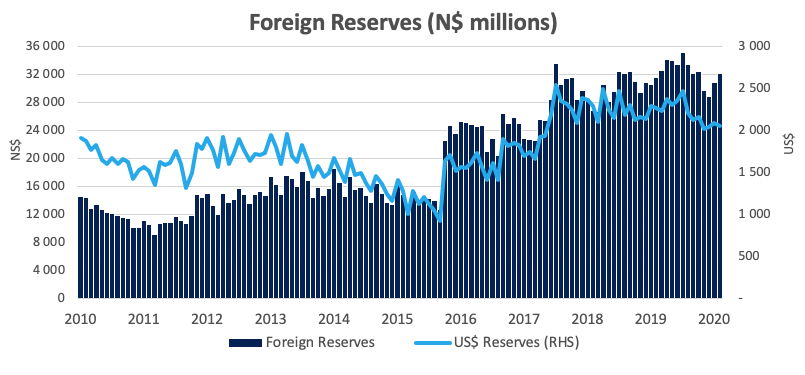

Reserves and Money Supply

As per the BoN’s latest money statistics release, broad money supply fell by N$816.1 million in February. Foreign reserve balances increased by N$1.21 billion to N$32.7 billion in February. According to the BoN, the increase mainly as a result of exchange rate fluctuations coupled with lower government payments during the month.

Outlook

Overall PSCE growth moderated for the first time in four months on a year-on-year basis, increasing by 5.87%. Rolling 12-month private sector credit issuance is down 10.0% from the N$6.39 billion issuance observed at the end of February 2019, with individuals taking up most (64.7%) of the credit extended over the past 12 months.

The above data precedes the economic impact of the coronavirus pandemic which we expect to have a detrimental impact on PSCE going forward. While the BoN’s MPC’s unexpected ‘early’ repo rate cut in March is likely to provide relief to heavily indebted consumers, we don’t anticipate that the more accommodative monetary policy will be effective in stimulating economic activity to the extent that it eliminates the impact of the external shock to the economy.

Given the 21-day lockdown of the two most economically significant regions announced by the Namibian government, we expect both consumers and businesses to increase their uptake of short-term debt going forward as a means of making ends meet, as most economic activity (and subsequently income) grinds to a halt while expenditure will still need to be covered.

NCPI – February 2020

The Namibian annual inflation rate ticked up slightly to 2.5% y/y in February, following the 2.1% y/y increase in prices recorded in January. Prices in the overall NCPI basket increased by 0.3% m/m. Overall, prices in eight of the twelve basket categories rose at a faster annual rate than in January, while four categories rose at a slower annual rate. Prices for goods increased by 3.5% y/y and 1.1% y/y.

Transport, the third largest basket item by weighting, was once again the largest contributor to annual inflation, accounting for 0.6 percentage points of the total 2.5% annual inflation rate. The basket category recorded price increases of 0.2% m/m and 4.4% y/y. The purchase of vehicles subcategory saw price increases of 3.8% y/y, while the operation of personal transport equipment subcategory recorded price increases of 5.9% y/y.

The price of Brent crude has plummeted this week after Saudi Arabia and Russia triggered an oil production war, combined with fears of the global economic impact of the fast-spreading coronavirus. The price of Brent crude fell 28.0% to US$33.0 per barrel this week as both the Saudis and Russians have committed to flood the market with record amounts of oil, we expect the oil price to remain low for the next few months. We thus expect the Ministry of Mines and Energy to cut fuel prices over the next few months, which will lead to lower transport inflation in the coming months.

Food & non-alcoholic beverages prices increased by 1.0% m/m and 2.8% y/y in February, ticking op from inflation of 2.2% y/y recorded in January. Despite this relatively subdued rate of inflation, this basket category made up the second largest portion of annual inflation. Prices in all thirteen of the sub-categories recorded increases on an annual basis. The largest increases were observed in the prices of fruits which increased by 15.0% y/y and fish which increased by 8.2% y/y. We expect muted inflation in this category after most parts of the country received good rainfall during February which is likely to have a positive impact on local food production.

Alcoholic beverages and tobacco prices, was the third largest contributor to the annual inflation rate in February, with prices in the basket increasing by 0.4% m/m and 2.7% y/y. Tobacco prices recorded an increase of 0.4% m/m, but a decrease of 4.4% y/y, while prices for alcoholic beverages recorded an increase of 0.4% m/m and 4.4% y/y.

The zonal data shows that on a monthly basis, prices declined by 0.1% in the northern zone 1 while rising elsewhere in the country. On an annual basis the Windhoek and surrounding area, in zone 2, recorded the lowest inflation rate at 2.1% y/y in July, with the northern region recording the highest rate of annual inflation at 2.8% y/y. Inflation in zone 3 (Eastern, Southern and Western Regions) remained unchanged at 2.5% y/y.

While the Namibian annual inflation print for February at 2.5% has ticked up from the 2.1% figure recorded in January, inflation remains at historically low levels. With low inflationary pressure due to adequate rainfall in most parts of the country, an oil-price war and a lack of domestic demand, we expect inflation to remain subdued in the coming months. IJG’s inflation model forecasts an average inflation rate of 2.8% y/y in 2020. This lower expected inflation and low economic growth forecasts means that there is still some leeway for both the South African Reserve Bank and the Bank of Namibia to cut repo rates at their next MPC meetings.