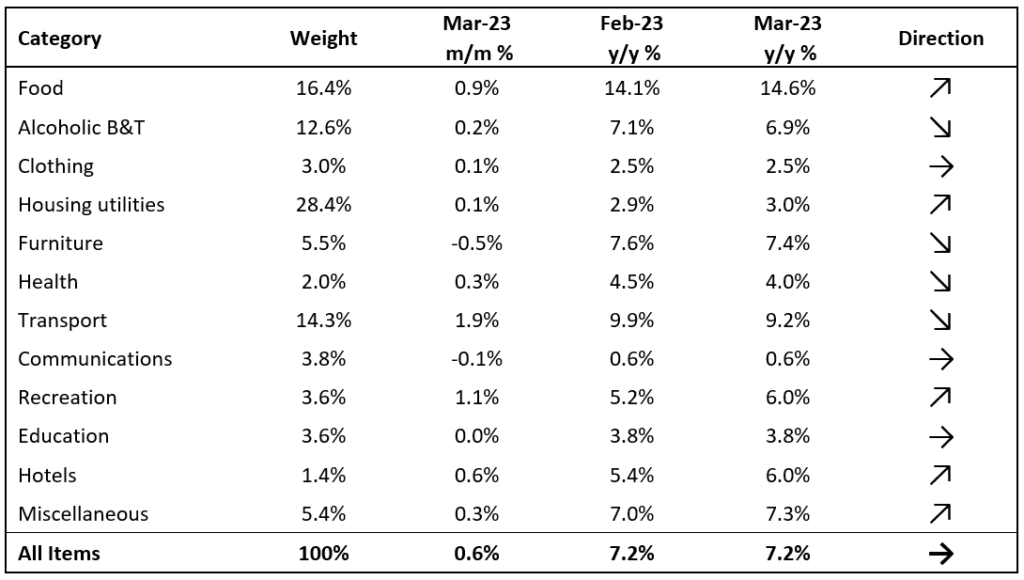

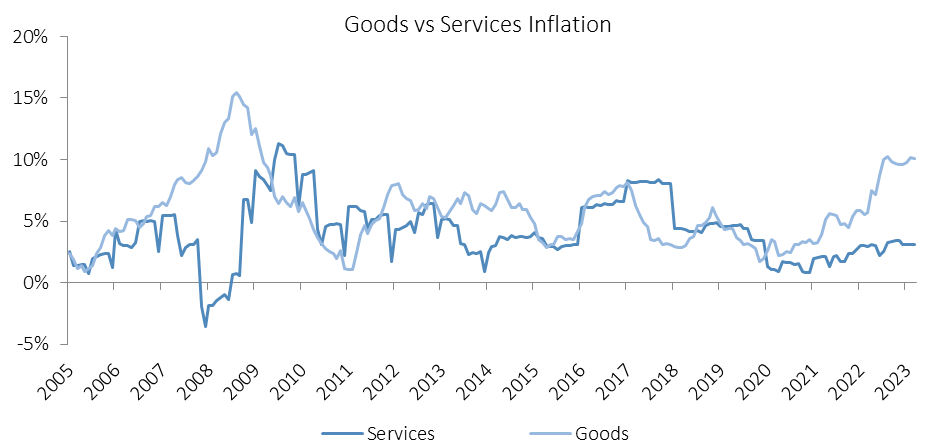

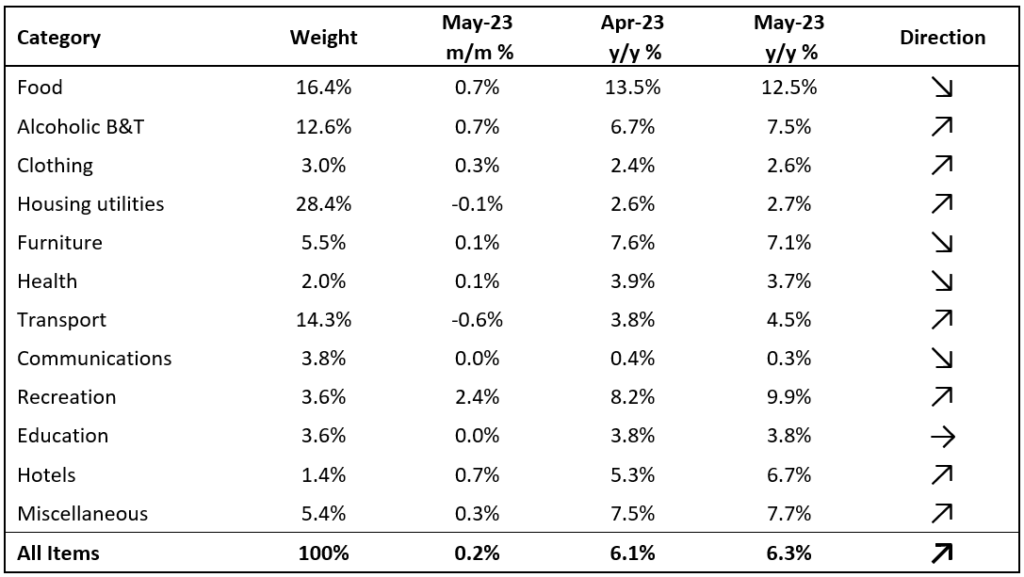

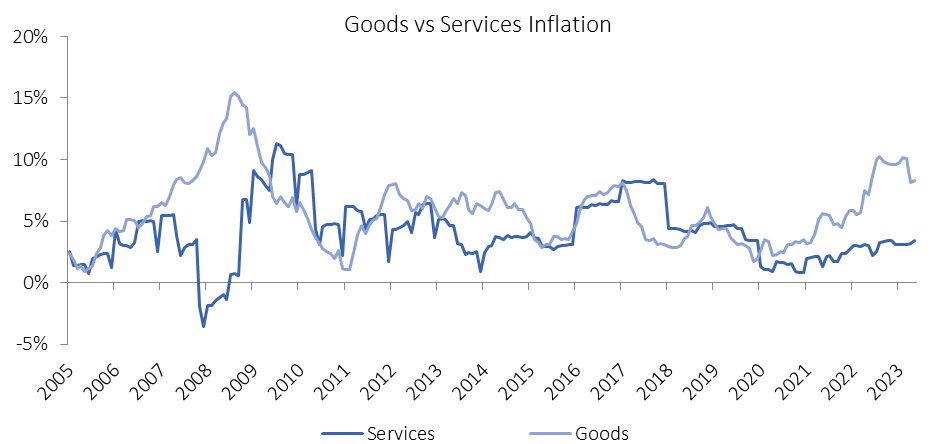

Namibia’s annual inflation rate edged up to 6.3% y/y in May, after softening to 6.1% y/y in April. On a month-on-month basis, prices in the overall NCPI basket rose by 0.2% m/m, following the 0.4% m/m increase in April. On an annual basis, overall prices in seven of the twelve basket categories rose at a quicker rate in May than in April, four categories recorded slower rates of inflation while the education category posted steady inflation. Both goods and services inflation edged higher in May, with goods inflation coming in at 8.3% y/y and services inflation at a much more subdued 3.4% y/y.

Inflation Attribution

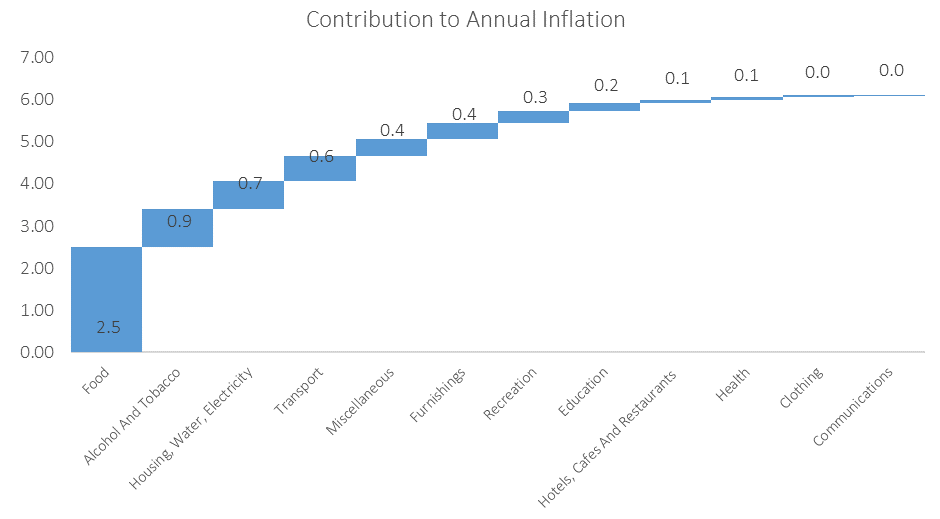

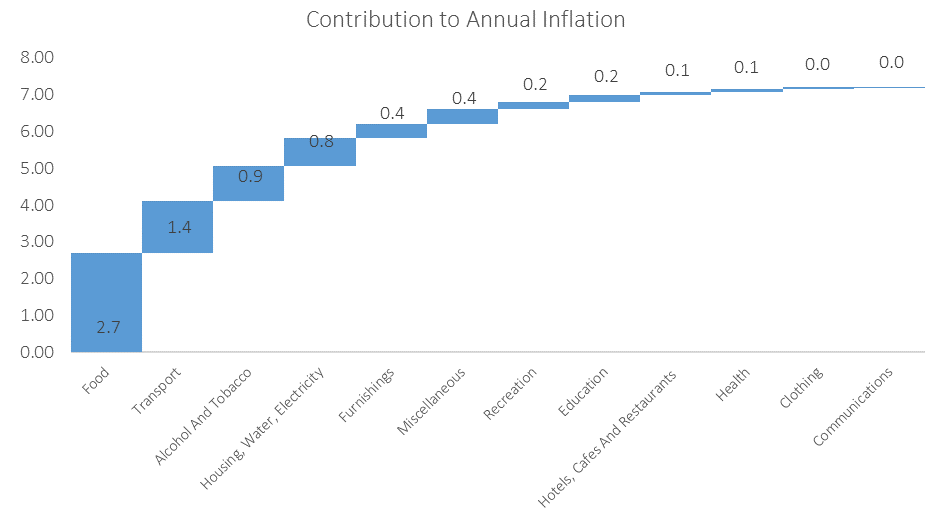

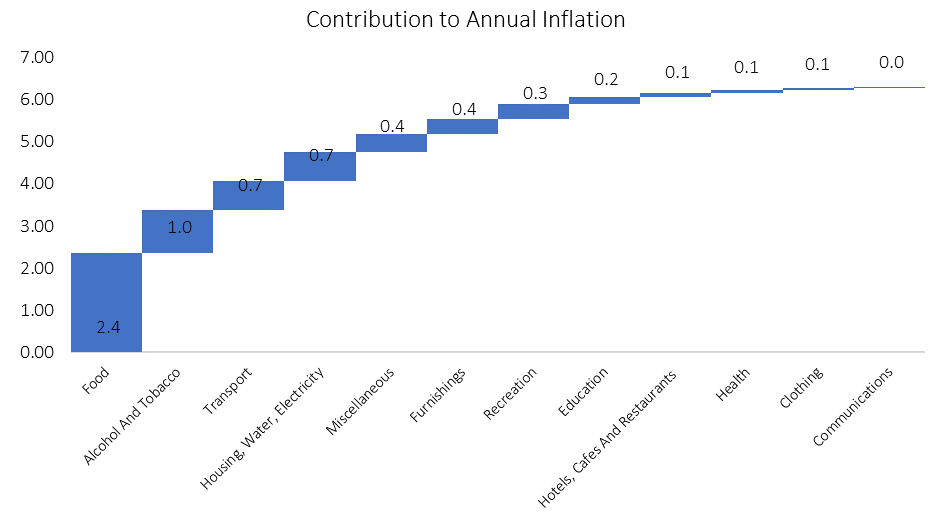

The Food and Non-Alcoholic beverages basket item was once again the largest contributor to Namibia’s annual inflation rate, contributing 2.4 percentage points in May. Prices of this basket item increased by 0.7% m/m and 12.5% y/y. Most of the sub-categories in this basket category witnessed slower annual inflation in May than in April but prices across the board remain relatively high. Fruits again posted the highest year-on-year inflation at 22.1% y/y in May (April: 29.1% y/y) while prices of items in the sub-category fell by 1.7% m/m. Fish saw the highest month-on month inflation with prices in this subcategory increasing by 4.5% m/m and 13.3% y/y. Oils and fats posted the most notable drop in inflation in May. Prices in this sub-category fell by 1.7% m/m while annual inflation slowed to 0.3% y/y in May (April: 10.7%).

The Alcohol and Tobacco basket item was the second largest contributor to May’s inflation print, contributing 1.0 percentage points. Prices in this basket item rose by 0.7% m/m and 7.5% y/y, slightly up from the 0.6% m/m and 6.7% y/y witnessed in April. Prices of alcohol products rose by 0.7% m/m and 8.4% y/y, while tobacco product prices rose by 0.9% m/m and 3.5% y/y in May. All of the sub-categories in this basket item registered faster annual inflation in May than in April, bar Liqueurs which saw prices deflate by 1.8% y/y.

Transport was the largest contributor to inflation among the remaining basket items, edging Housing, Water, Electricity as one of the top three contributors to Namibia’s annual inflation rate, despite prices in this basket item dropping by 0.6% m/m. Public transport services inflation remained fairly steady at 0.1% m/m and 1.0% y/y. The operation of personal transport equipment inflation rose by 4.7% y/y in May, while the cost of operating personal transport equipment fell 1.1% m/m. The Ministry of Mines and Energy’s decision to lower the price of diesel 50ppm and 10ppm by 80c/litre and 60c/litre, respectively, with effect from June should bring further price relief for this sub-category going forward. Inflation on vehicles purchases slowed to 0.4% m/m and 6.5% y/y, from 1.1% m/m and 6.3% y/y a month earlier.

Outlook

Namibia’s inflation rate witnessed a slight increase in May, primarily driven by food price pressures that persist as a dominant factor in the inflation dynamics.

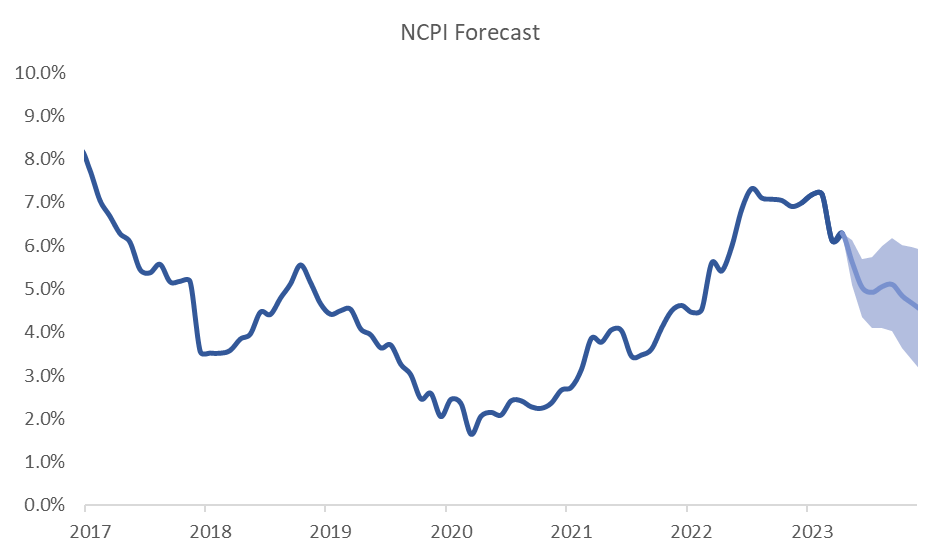

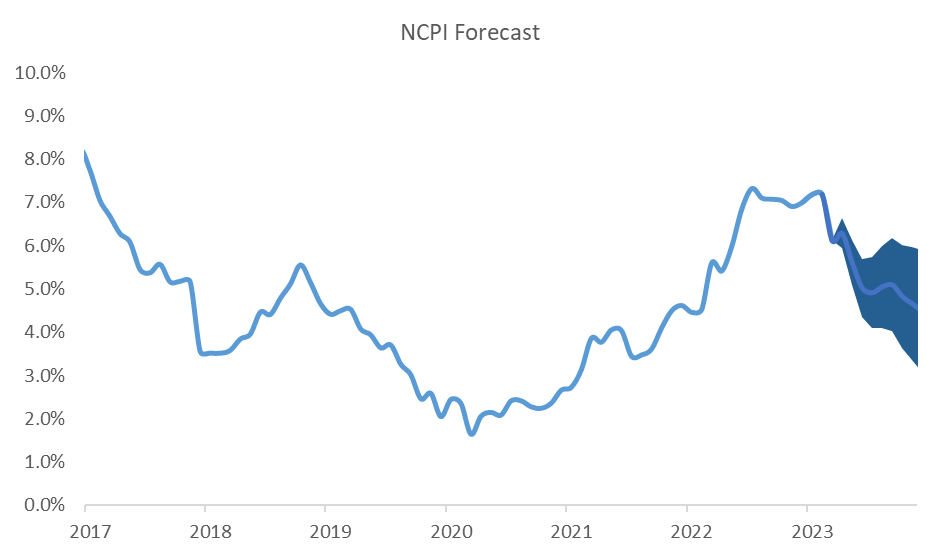

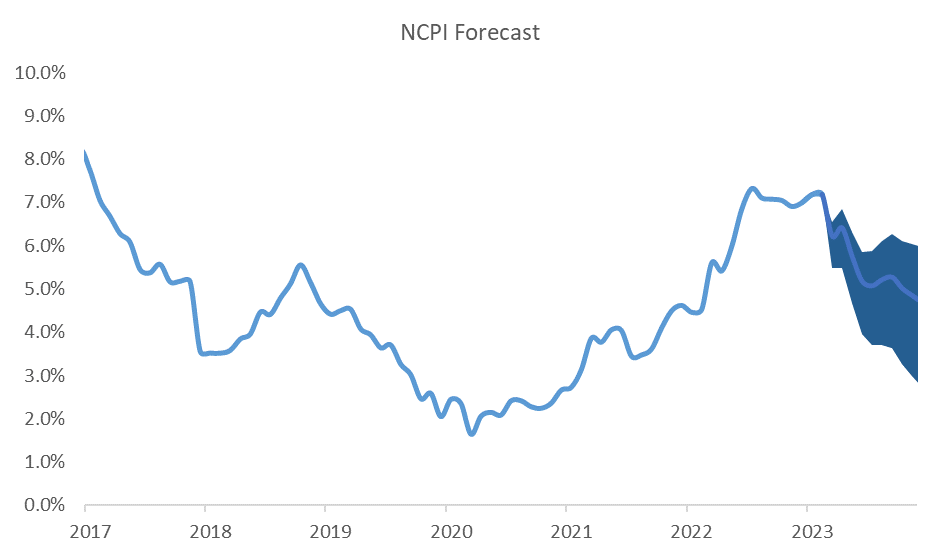

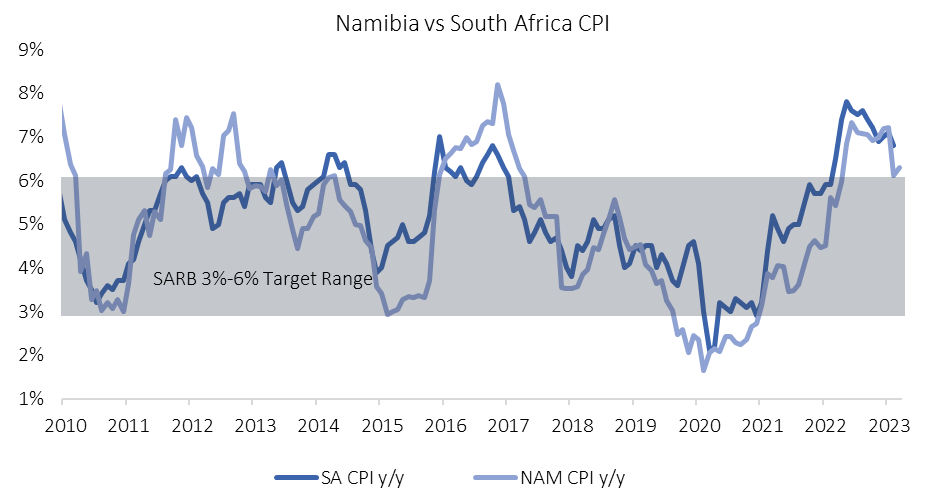

Despite these developments, it is expected that the annual inflation rate in Namibia will gradually decrease in the coming months. This is primarily due to base effects impacting the Transport category, as fuel prices are now only marginally higher compared to a year ago. However, if currency weakness persists, we could see upward price pressure on goods, resulting in a prolonged period of elevated inflation. The Bank of Namibia is expected to closely monitor these developments, and it may require implementing additional rate hikes beyond current expectations, similar to the situation observed in neighbouring South Africa.

IJG’s inflation model continues to forecast a gradual deceleration in the annual inflation rate over the coming months, before ending the year at around 4.8%.