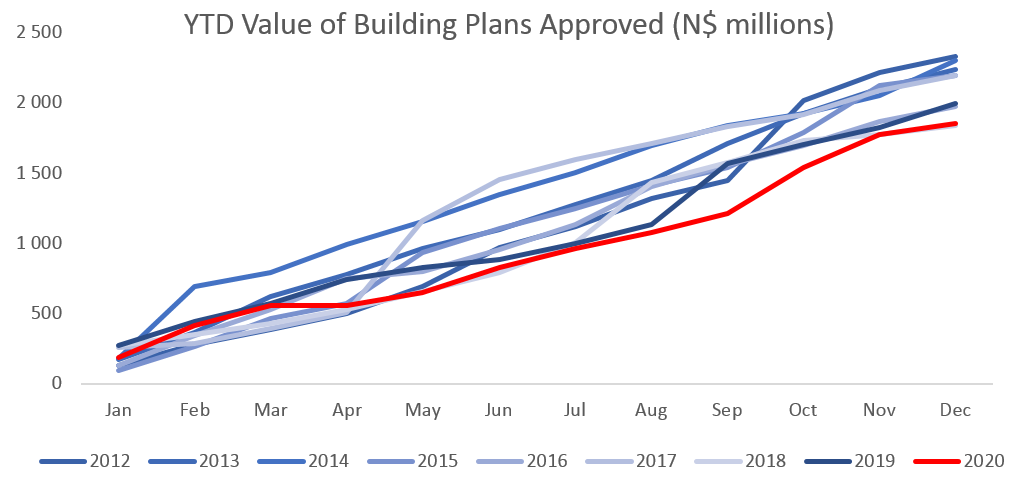

A total of 122 building plans were approved by the City of Windhoek in January, representing a 6.1% m/m increase from the 115 building plans approved in December. In monetary terms, the approvals were valued at N$84.0 million, an 11.5% m/m increase, while buildings with a value of N$57.6 million were completed during January, a 79.9% m/m increase. 2021 is off to a slower start in terms of value of approvals, compared to January 2020 when 121 building plans worth N$189.4 million got the nod. On a twelve-month cumulative basis, 2,283 building plans worth approximately N$1.75 billion were approved, an increase in number of 14.7% y/y, but a decline of 8.5% y/y in value terms over the prior 12-month period.

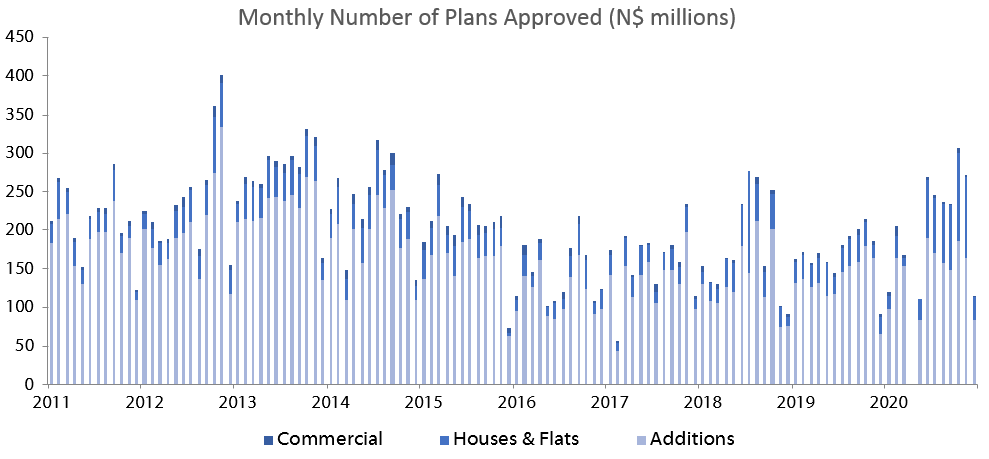

In terms of number of approvals, additions to properties made up the largest portion of approvals. For the month of January, 71 additions to properties were approved with a value of N$25.7 million, 7 more than the number of additions approved in January 2020. The value of the additions approved in January is however 55.6% lower than those observed in the first month of 2020. 4 additions worth N$890,000 were completed during the month.

New residential units were the second largest contributor to the total number of building plans approved in January. 50 new units worth N$51.3 million were approved in January, representing a 102.9% increase from the N$51.3 million worth of approvals in the first month of 2020. On a 12-month cumulative basis, residential units recorded a 74.6% y/y increase in value. 30 new residential units worth N$57.6 million were completed during the month.

Only 1 new commercial unit, valued at N$7.0 million, was approved in January. This compares to 6 units valued at N$136.0 million approved in January 2020. On average over the last 20 years, 4 commercial units valued at N$26.5 million were approved in the first month of the year. On a rolling 12-month perspective, the number of commercial and industrial approvals have slowed to 36 units worth N$202.2 million as at January, compared to the 51 approved units worth N$641.6 million over the corresponding period a year ago. No commercial and industrial units were completed in January.

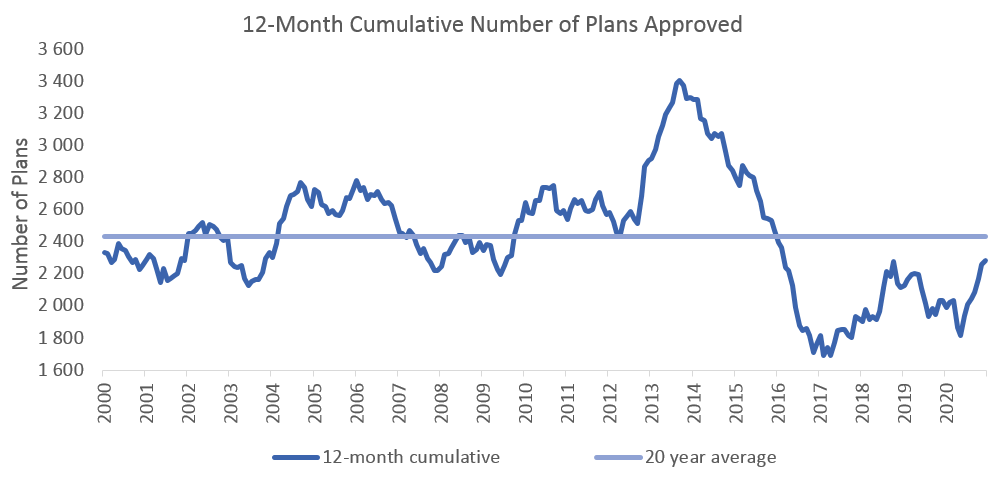

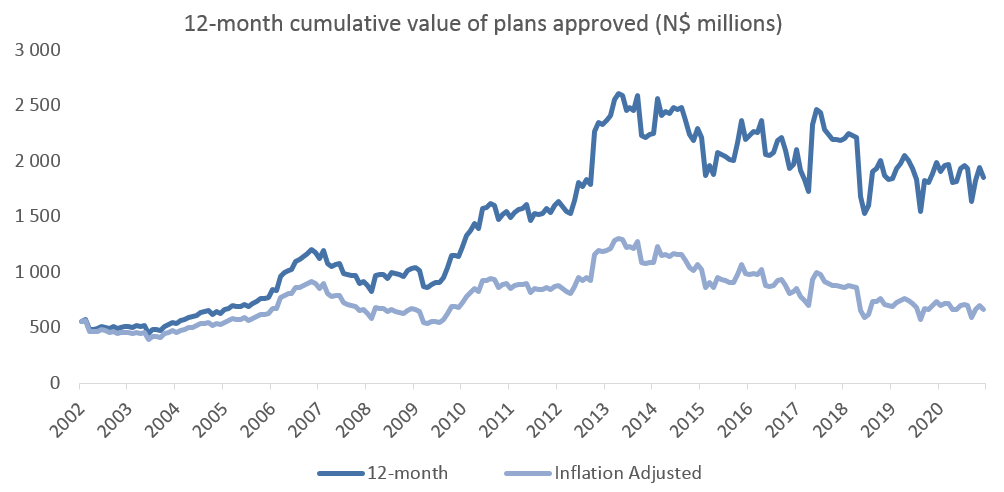

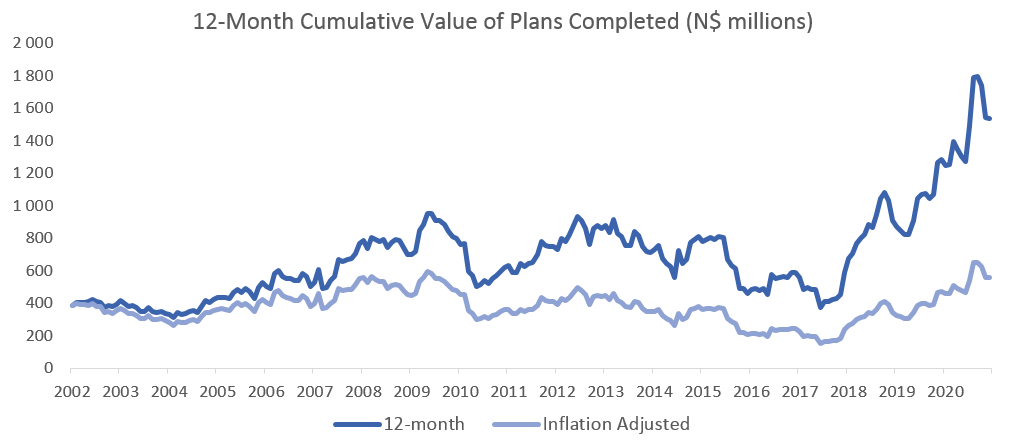

The 12-month cumulative number of building plans approved increased by 14.7% y/y in January. A total of 2,283 building plans to the value of N$1.75 billion were approved over the last 12 months which represents a decline in value terms of 8.5% y/y. Additions to properties have made up 68.9% of the cumulative number of approvals, but only 39.4% of the total value of approvals, indicating that the planned construction activity will mostly consist of smaller building projects. The low single digit number of commercial approvals witnessed over the last 11 months indicates that most businesses are not planning on expanding their existing operations. It is evident that the Namibian construction industry continues to tread water as the value of approvals continues to decline in real terms.