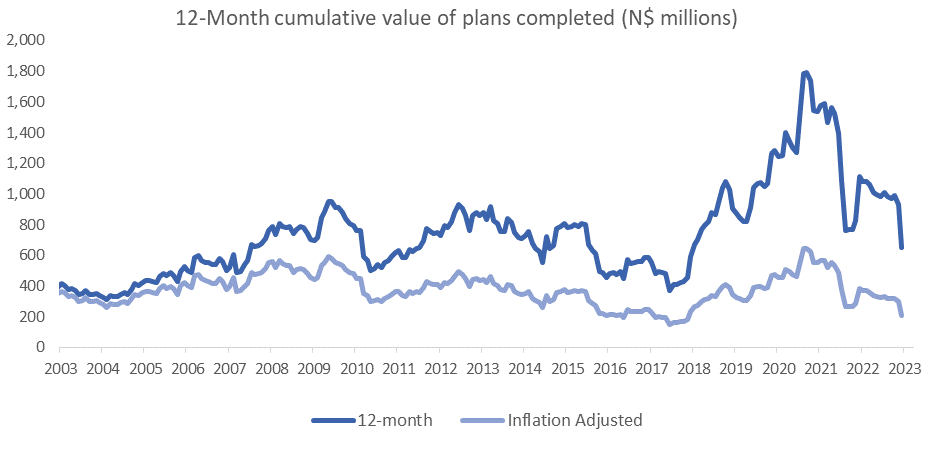

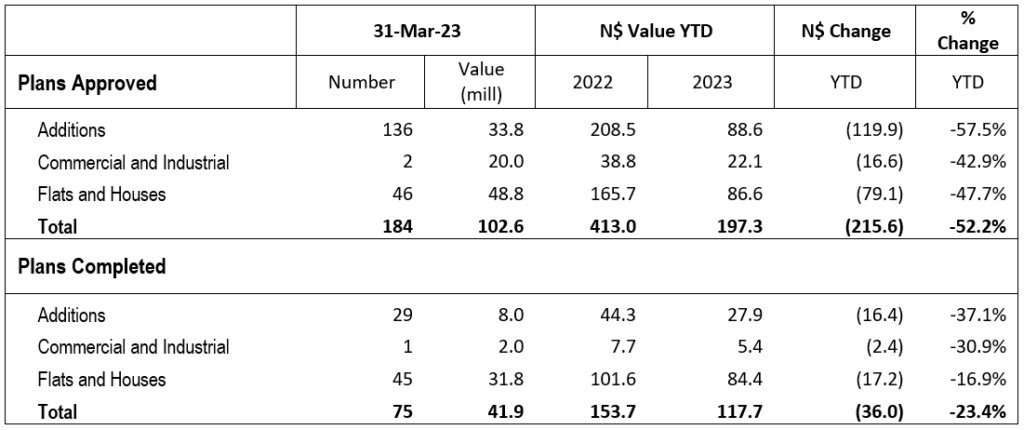

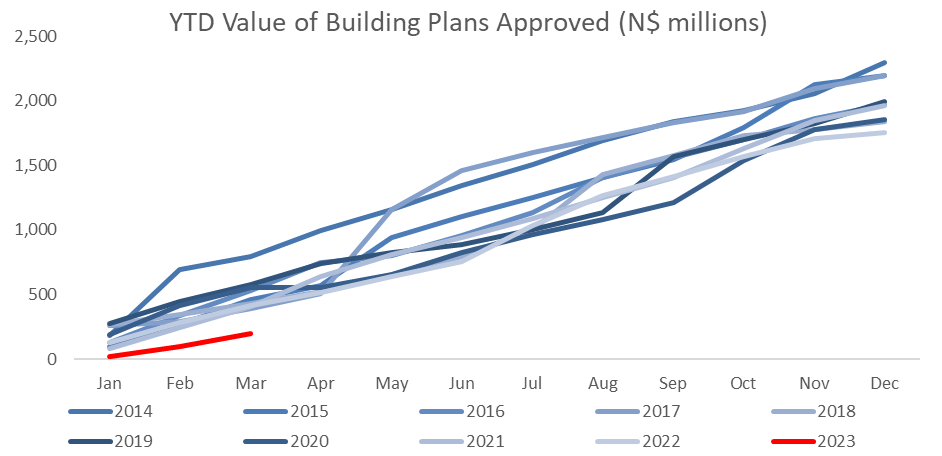

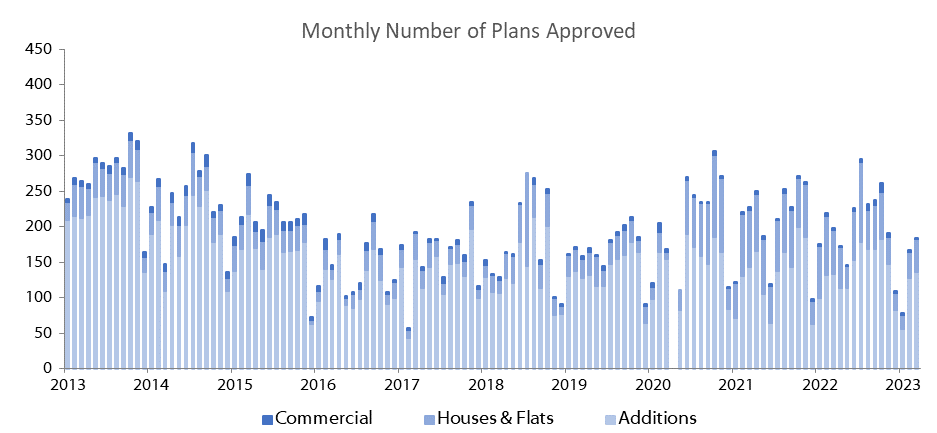

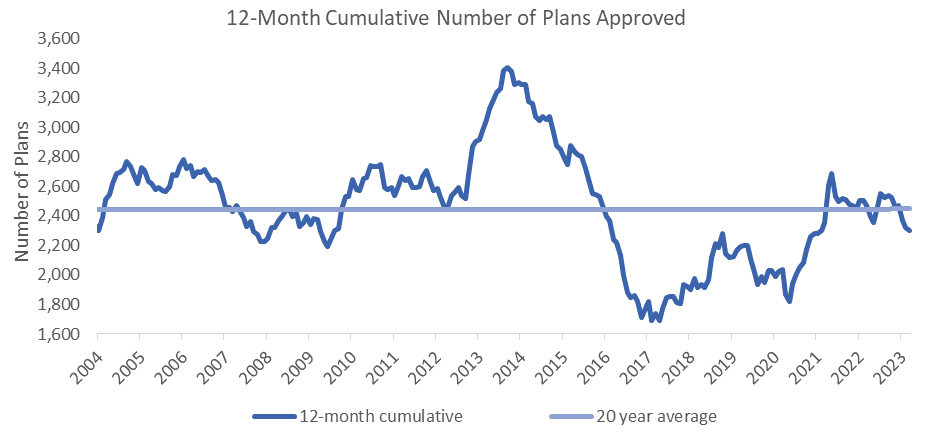

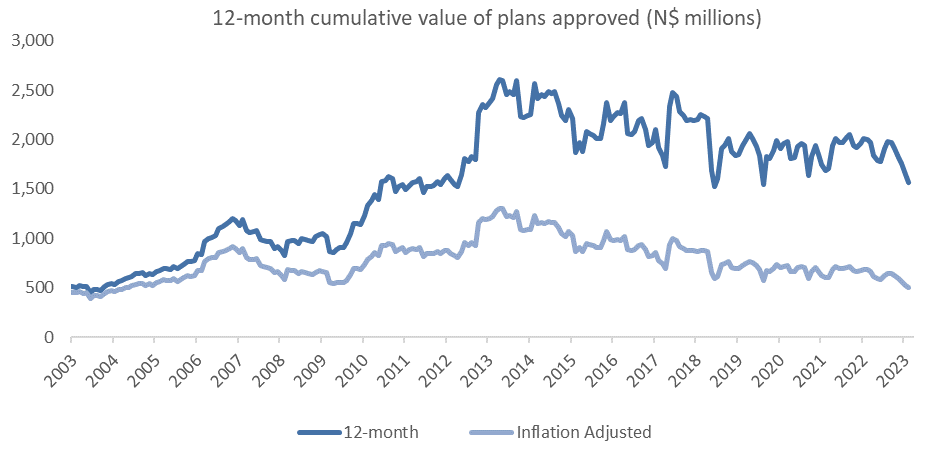

A total of 184 building plans was approved by the City of Windhoek in March, a 10.2% m/m increase from the 167 approved in February. In monetary terms, the approvals were valued at N$102.6 million, a 41.1% m/m increase from the N$72.67 million approved in February. The first quarter of the year saw 430 building plans worth N$197.3 million approved, a contraction of 27.5% in number terms and 52.2% less in value terms compared to the first quarter of 2022. On a twelve-month cumulative basis, 2,304 buildings worth N$1.53 billion were approved, a decline of 6.8% in number- and 21.9% in value terms over the comparative 12-month period a year ago. 75 building plans worth N$41.86 million were completed during March.

March saw 136 additions to properties approved valued at N$33.81 million, 3 more than in March 2022 but N$22.43 million less in value terms. On a year-to-date basis, 319 additions to properties worth N$88.6 million were approved in the first quarter of 2023, representing a 12.4% decline in number terms and a 57.5% contraction in value terms compared to the first quarter of last year. On a 12-month cumulative basis, the number and value of additions to properties continued to decline and dropped below the levels seen for the corresponding 12-month period a year earlier. 29 Additions, worth N$8.03 million were completed during the month.

46 new residential units valued at N$48.75 million were approved in March, the highest monthly new residential unit approvals reported so far this year. Year-to-date, 103 new residential units worth N$86.6 million have been approved, down 53.2% from the 220 units worth N$165.7 million approved over the first quarter of 2022. The slump is also reflected in the 12-month cumulative figures which came in at 618 units worth N$624.9 million, a drop of 26.6% y/y in number terms and a contraction of 35.7% y/y in value terms. A total of 45 residential units worth N$31.83 million were completed during the month.

2 new commercial and industrial units worth N$20 million was approved in March. This brings the year-to-date approvals to 8 commercial buildings worth N$22.1 million, representing a 42.9% y/y drop from the N$38.8 million worth of commercial and industrial units approved over the first quarter of last year. On a rolling 12-month perspective, the number of commercial and industrial approvals remained unchanged at 56 units but dropped in value terms to N$146.2 million from N$156.2 million a month earlier. Only 1 commercial and industrial unit was completed for the second month in a row.

March’s building plans data showed a slight improvement from February but continue to decent compared to the data from a year ago. The graphs above and below depict that the planned construction activity in the capital has gotten off to a weak start in 2023, like the previous lows of 2009, marking it the weakest start to a year in the past decade. More hardship is expected over the shorter term with local interest rates almost certain to rise even further in April which will make borrowing cost for new construction projects even more expensive in an already tepid economy. Meanwhile, the Construction Industries Federation of Namibia (CIF) continue its efforts in encouraging the government to establish a Construction Council which it believes will assist in stemming unwanted practices in the sector which arguably will improve competition and drive down construction costs – one of the factors deterring growth in this sector.