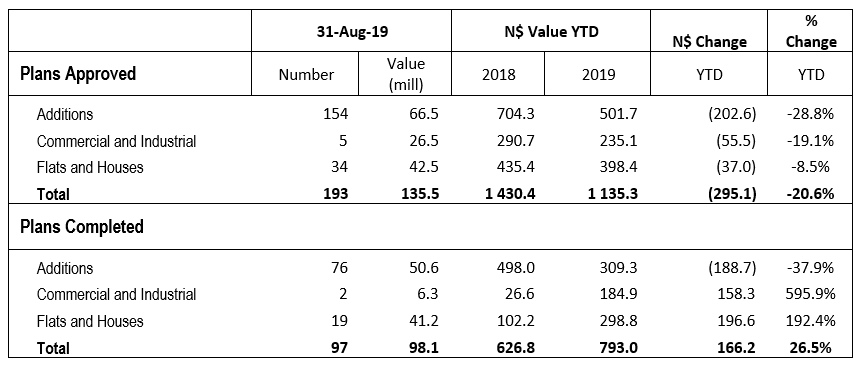

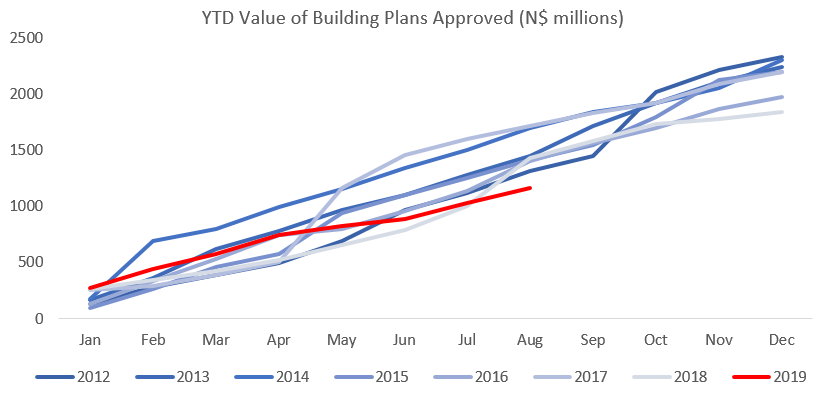

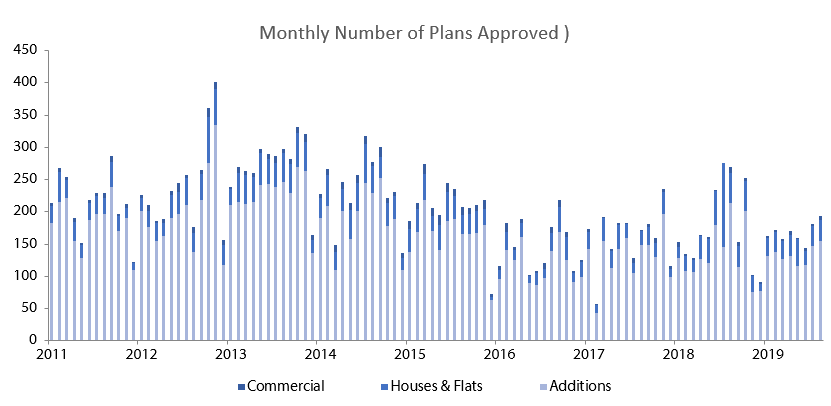

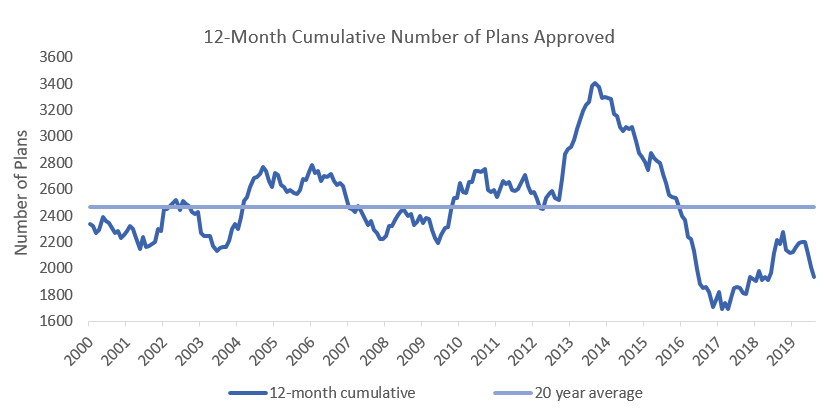

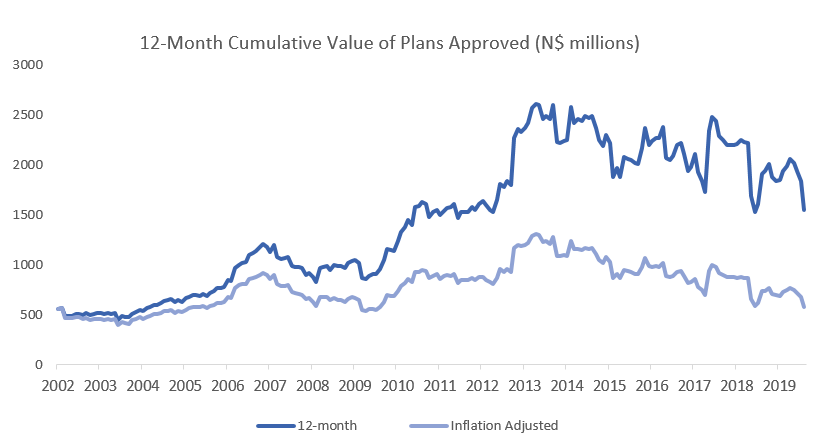

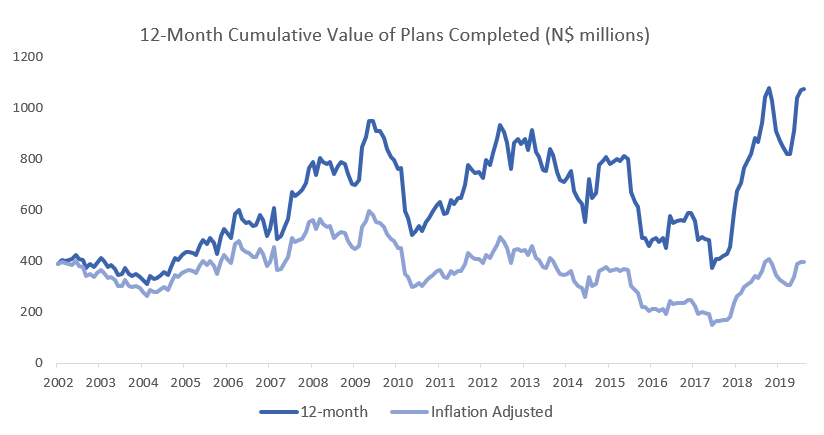

A total of 193 building plans were approved by the City of Windhoek in August, 12 more than in July. The value of approvals increased to N$135.5 million in August as opposed to N$114.9 million in June. A total of 97 building plans were completed during the month with a value of N$98.1 million. Year-to-date, N$1.14 billion worth of building plans have been approved, 20.6% lower than the corresponding period in 2018. On a twelve-month cumulative basis, 1,937 building plans have been approved worth approximately N$1.54 billion, 19.1% lower in value terms than cumulative approvals in August 2018.

154 additions to properties were approved in August with a value of N$66.5 million, a drop of 8.9% m/m and 20.0% y/y in value terms. Year-to-date 1,061 additions to properties have been approved with a total value of N$501.7 million, a decrease of 5.9% y/y in number and 28.8% y/y in value terms. On a 12-month cumulative basis, the number of additions approved contracted by 10.3% y/y and 29.4% y/y in value terms. Year-to-date 607 additions have been completed with a combined value of N$309.3 million, down 61.8% y/y in number and 37.9% y/y in value terms.

New residential units accounted for 34 of the approvals registered in August, an increase of 9.7% m/m. In value terms, N$42.5 million worth of residential units were approved in August, increasing by 139.9% m/m but contracting by 54% y/y. Year-to-date residential unit approvals have decreased by 31.3% y/y in number and 8.5% y/y in value terms. On a 12-month cumulative basis, residential units recorded a 20.1% y/y decrease in number of approvals and a 7.4% y/y in value.

5 new commercial units, valued at N$26.5 million, were approved in August, bringing the year-to-date number of commercial and industrial approvals to 28, worth a total of N$235.1 million. Year-to-date, this is the same number of commercial approvals compared to the corresponding period in 2018, but represents a contraction of 19.1% y/y in value terms. On a rolling 12-month basis, the number of commercial and industrial approvals fell to 43 units worth N$495.1 million as at the end of August. This is a decrease of 15.7% y/y in number and 6.2% y/y in value. The drop-in figures indicate the declining level of activity in the industry.

In the last 12 months 1,937 building plans have been approved, decreasing by 12.4% compared to August 2018. These approvals amounted to N$1.54 billion, representing a decrease in value of 19.1% y/y. According to the Namibia Statistics Agency, construction industry recorded a negative sectoral growth rate of 27.8% in the first quarter of 2019 and 5.5% in the second quarter. We expect this trend to continue in the medium-term, given the current state of the economy. This continues to be of concern as the construction industry forms part of the key sectors along with mining and agriculture in the Namibian economy.

The BoN took the decision to cut interest rates by 25 bps in August and this has brought some relief to indebted consumers and businesses. However, private sector credit extension for August indicates that although there has been an increase in the uptake of credit on year-to-year basis, it has mainly been short-term and overdraft facilities. Household have taken up most (64.3%) of the credit extended compared to businesses. The outlook remains gloomy as the extension of short-term debt remains on the rise as opposed to financing for more productive loans.

The latest GDP data from the Namibia Statistics Agency indicates that key economic sectors remain under pressure and the economy is contracting by more than initial projections by the central bank. According to the NSA, the economy has contracted by 2.6% in the second quarter of 2019 with growth in the construction sector contracting by 5.5% in real value-added terms. We expect the economy, and construction activity as a result, to remain under pressure as both consumer and business confidence remains low.