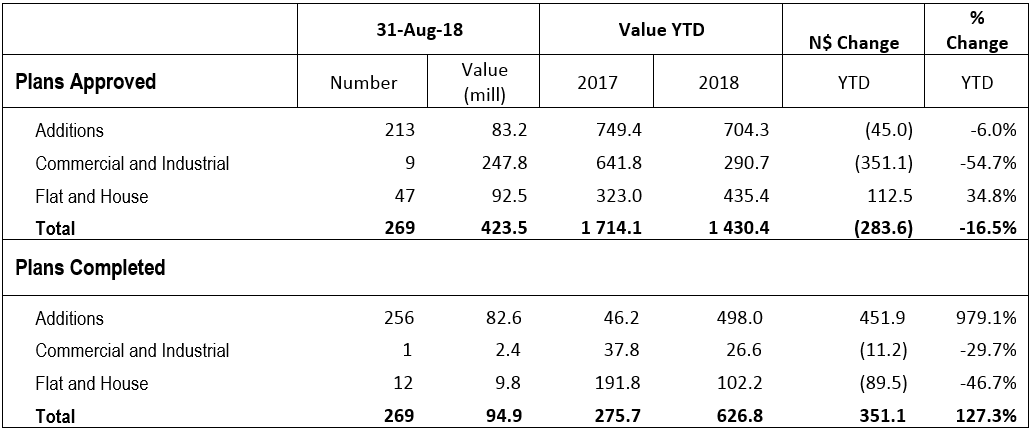

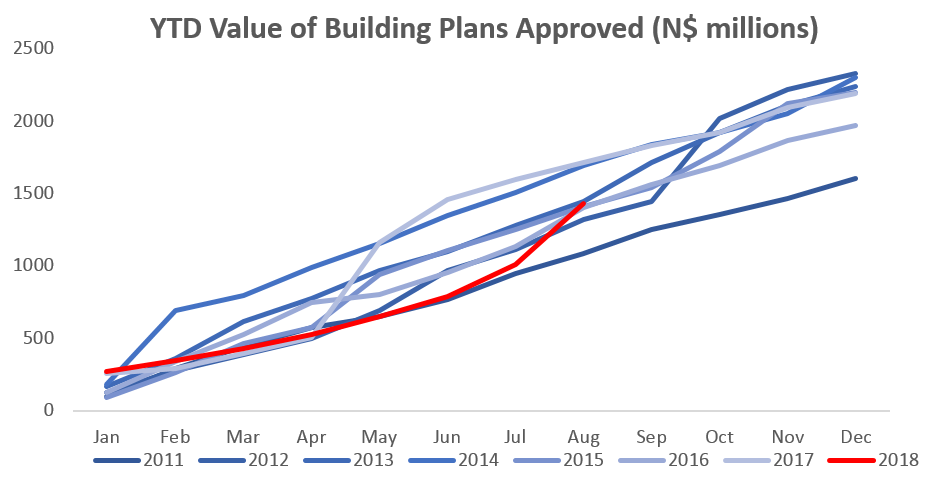

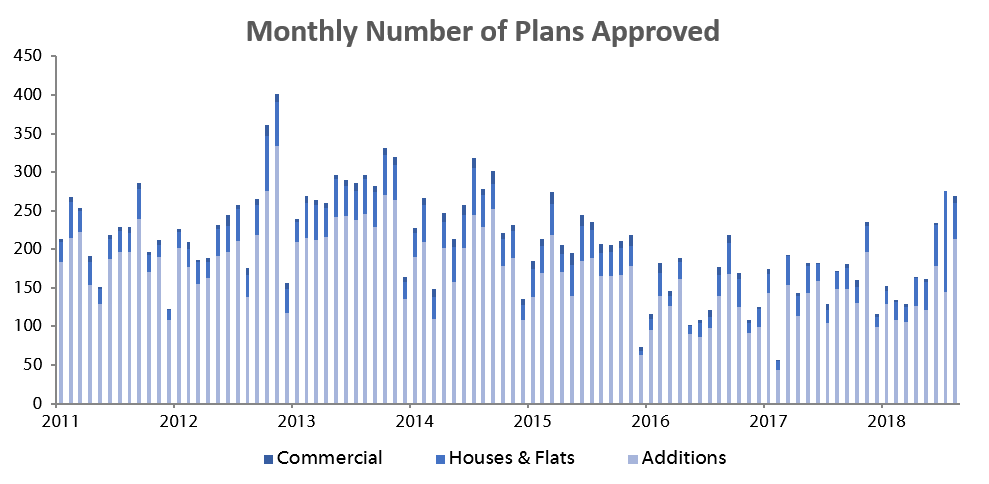

A total of 269 building plans were approved by the City of Windhoek in August, decreasing by 2.5% m/m but increasing by 56.4% y/y. In value terms, however, approvals increased by N$208.8 million to N$423.5 million, a 264.4% m/m and 97.3% y/y increase. A total of 269 completions to the value of N$94.9 million were recorded in August, a 3.5% y/y increase in number and 21.7% up y/y in value. The year-to-date value of approved building plans reached N$1.43 billion, 16.5% lower than the comparative period a year ago. On a twelve-month cumulative basis, 2,212 building plans were approved worth approximately N$1.91 billion, 16.4% lower in value terms than approvals as at the end of August 2017.

The majority of the number of building plan approvals were made up of additions to properties. For the month of August, 213 additions were approved worth N$83.2 million, 14.1% less in value terms than in July, although the number of additions approved increased by 46.9% m/m and 43.9% y/y. Year-to-date, 1,128 additions have been approved, which is 120 more than in the corresponding period last year. In value terms, $704.3 million worth of additions have been approved year-to-date, a decrease of 6.0% y/y.

New residential units were the second largest contributor to building plans approved, accounting for 47 of the total 269 approvals registered in August. Year-to-date, 364 new residential units have been approved, 168 more than during the corresponding period in 2017. In monetary terms, N$435.4 million worth of residential plans have been approved year-to-date, an expansion of 34.8% when compared to the corresponding period last year.

Commercial and industrial building plans approved amounted to 9 units, worth N$247.8 million for August. The largest single commercial building plan approval of the month amounted to N$148 million. Year-to-date, 28 plans for commercial and industrial purposes have been approved which is one more than in the corresponding period in 2017. However, the year-to-date value of commercial and industrial approvals at N$290.7 million is 54.7% lower than in the corresponding period last year. This highlights the lack of commercial and industrial development in the first half of 2018.

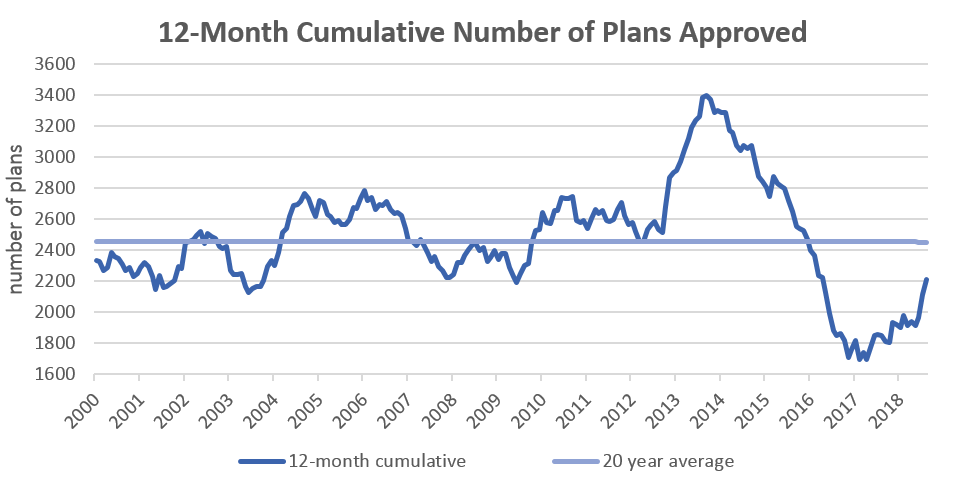

From a 12-month cumulative perspective, 2,212 total building plans have been approved by August, an increase of 19.5% y/y. In value terms however, approvals are down 16.4% y/y over the same period. The latest private sector credit extension data showed slowing growth in credit extended to corporates and individuals in July. Mortgage loans extended to corporates contracted by 1.9% m/m in July, but rose by 1.0% m/m for individuals. Commercial banks currently enjoy a healthy monthly average liquidity position of N$4.8 billion, providing sufficient levels of loanable funds. Banks are, however, currently weary of the construction industry as the balance sheets of many of the companies are stretched. Low consumer and business confidence, coupled with an increasing likelihood of interest rate hikes over the next 24 months, means that the credit appetite of both individuals and corporates is currently low and that no significant improvement in the approvals and completions numbers are expected in the short term.