Twitter Timeline

[custom-twitter-feeds]

Categories

- Calculators (1)

- Company Research (296)

- Capricorn Investment Group (52)

- FirstRand Namibia (53)

- Letshego Holdings Namibia (25)

- Mobile Telecommunications Limited (7)

- NamAsset (3)

- Namibia Breweries (45)

- Oryx Properties (58)

- Paratus Namibia Holdings (6)

- SBN Holdings Limited (17)

- Economic Research (660)

- BoN MPC Meetings (13)

- Budget (19)

- Building Plans (142)

- Inflation (142)

- Other (28)

- Outlook (17)

- Presentations (2)

- Private Sector Credit Extension (141)

- Tourism (7)

- Trade Statistics (4)

- Vehicle Sales (143)

- Media (25)

- Print Media (15)

- TV Interviews (9)

- Regular Research (1,801)

- Business Climate Monitor (75)

- IJG Daily (1,604)

- IJG Elephant Book (12)

- IJG Monthly (108)

- Team Commentary (250)

- Danie van Wyk (61)

- Dylan van Wyk (27)

- Eric van Zyl (16)

- Hugo van den Heever (1)

- Leon Maloney (11)

- Top of Mind (4)

- Zane Feris (12)

- Uncategorized (6)

- Valuation (4,479)

- Asset Performance (116)

- IJG All Bond Index (2,076)

- IJG Daily Valuation (1,802)

- Weekly Yield Curve (484)

Meta

Author Archives: IJGResearch

IJG Daily Valuation 14 November 2019

New Vehicle Sales – October 2019

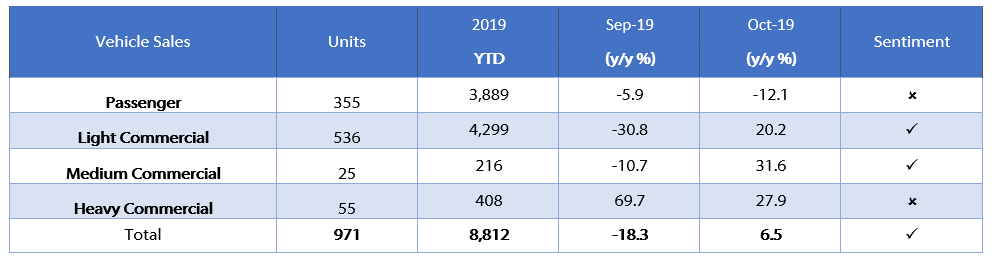

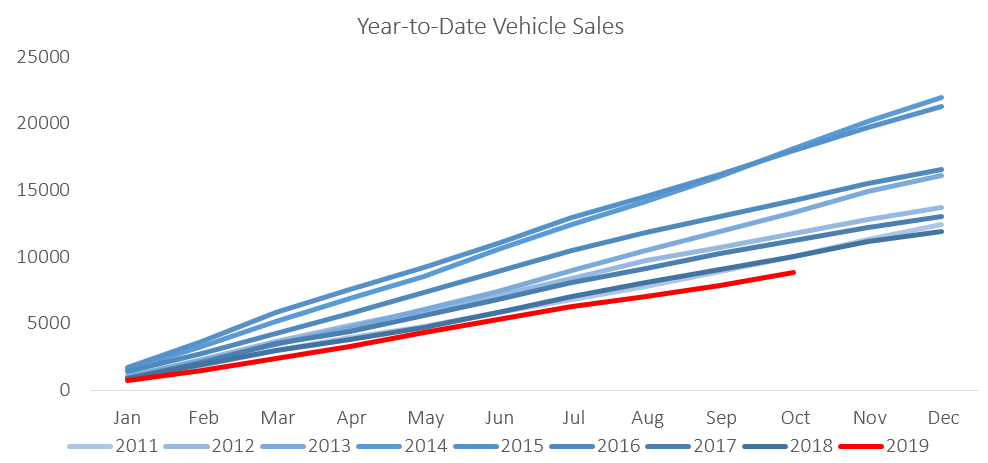

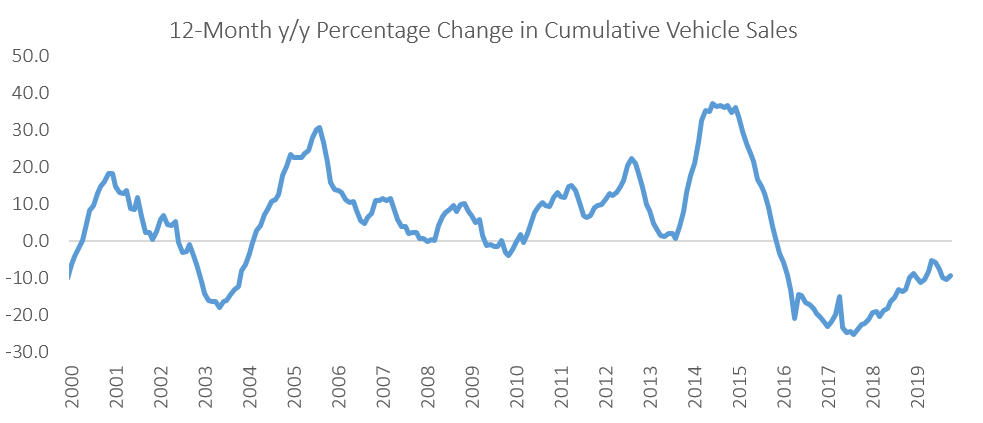

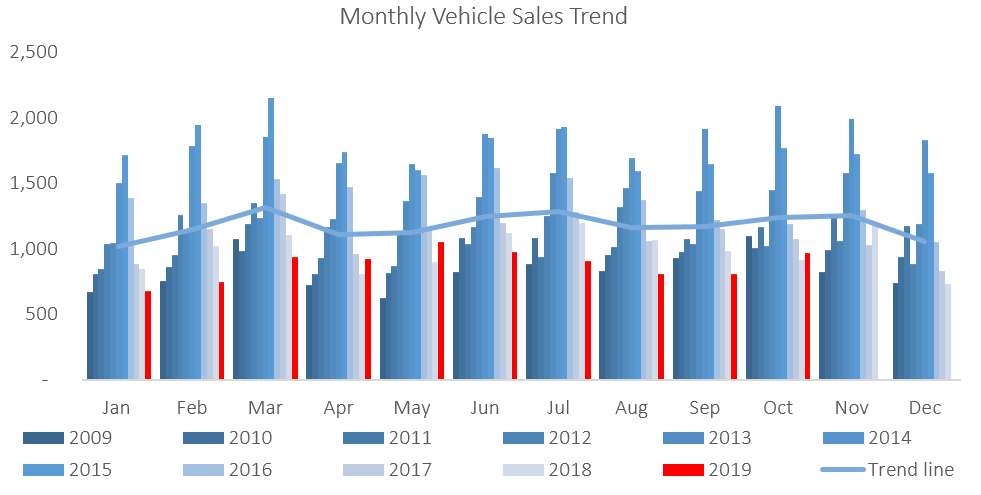

A total of 971 new vehicles were sold in October, representing a 20.5% m/m increase from the 806 vehicles sold in September. Year-to-date, 8,812 new vehicles have been sold of which 3,889 were passenger vehicles, 4,299 were light commercial vehicles, and 624 were medium and heavy commercial vehicles. This is the highest number of new vehicles sold recorded over the last four months. On a twelve-month cumulative basis, new vehicle sales continued its downward trend. 10,739 new vehicles were sold over the last twelve months, a 9.1% contraction from the previous twelve months.

355 new passenger vehicles were sold in October, an increase of 10.9% m/m, but contracting by 12.1% y/y. Year-to-date new passenger vehicle sales rose to 3,889 units, down 11.2% when compared to the year-to-date figure recorded in October 2018. Twelve-month cumulative passenger vehicle sales fell 10.5% y/y as the number of passenger vehicles sold continued to decline.

A total of 616 new commercial vehicles were sold in October, increasing by 26.7% m/m and 21.3% y/y. Of the 616 new commercial vehicles sold in October, 536 were classified as light commercial vehicles, 25 as medium commercial vehicles and 55 as heavy or extra heavy commercial vehicles. 408 heavy vehicles were sold year-to-date, the highest sales figure for the period since October 2016. On a twelve-month cumulative basis, light commercial vehicle sales dropped 9.9% y/y, while medium commercial vehicle sales and heavy commercial vehicles rose 2.1% y/y and 13.3% y/y, respectively. For the sixth consecutive month, there has been an increase in the sale of heavy commercial vehicles on a 12 month cumulative year-on-year basis. The steady increase in this category indicates improved demand for durable goods by businesses.

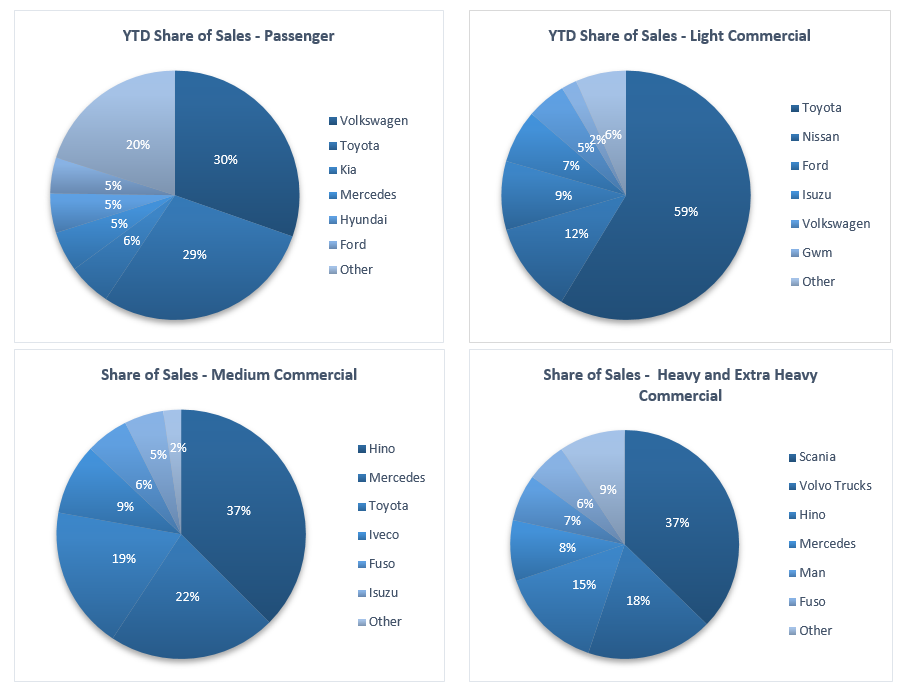

Volkswagen continues to lead the passenger vehicle sales segment with 30.4% of the segment sales year-to-date. Toyota remained in second place with 29.0% of the market-share as at the end of October. Kia, Mercedes, Hyundai and Ford each command around 5% of the market in the passenger vehicles segment, leaving the remaining 20.1% of the market to other brands.

Toyota retains a strong year-to-date market share of 58.7% and remains the market leader in the light commercial vehicle segment. Nissan remains in second position in the segment with 11.8% of the market, while Ford makes up third place with 8.9% of the year-to-date sales. Hino leads the medium commercial vehicle segment with 37.5% of sales year-to-date, while Scania was number one in the heavy- and extra-heavy commercial vehicle segment with 37.3% of the market share year-to-date.

The Bottom Line

Vehicle sales remain under pressure, with the year-to-date new vehicle sales in 2019 currently below 2010 levels, and the total new vehicle sales for the last 12 months down 9.1% from the same period in 2018. Both new commercial and new passenger vehicle sales are at their lowest year-to-date levels since 2009. However there has been an improvement in the demand for new medium and heavy commercial vehicles in 2019. Although this improvement has come off a very low base, it suggests that the sectors of the economy that rely on these categories of vehicles may have turned the corner. However, we continue to expect business and consumer confidence to remain low and thus expect subdued demand for new vehicles going forward.