Twitter Timeline

[custom-twitter-feeds]

Categories

- Calculators (1)

- Company Research (295)

- Capricorn Investment Group (51)

- FirstRand Namibia (53)

- Letshego Holdings Namibia (25)

- Mobile Telecommunications Limited (7)

- NamAsset (3)

- Namibia Breweries (45)

- Oryx Properties (58)

- Paratus Namibia Holdings (6)

- SBN Holdings Limited (17)

- Economic Research (659)

- BoN MPC Meetings (13)

- Budget (19)

- Building Plans (142)

- Inflation (142)

- Other (28)

- Outlook (17)

- Presentations (2)

- Private Sector Credit Extension (140)

- Tourism (7)

- Trade Statistics (4)

- Vehicle Sales (143)

- Media (25)

- Print Media (15)

- TV Interviews (9)

- Regular Research (1,795)

- Business Climate Monitor (75)

- IJG Daily (1,598)

- IJG Elephant Book (12)

- IJG Monthly (108)

- Team Commentary (250)

- Danie van Wyk (61)

- Dylan van Wyk (27)

- Eric van Zyl (16)

- Hugo van den Heever (1)

- Leon Maloney (11)

- Top of Mind (4)

- Zane Feris (12)

- Uncategorized (6)

- Valuation (4,463)

- Asset Performance (115)

- IJG All Bond Index (2,068)

- IJG Daily Valuation (1,796)

- Weekly Yield Curve (483)

Meta

Author Archives: IJGResearch

IJG Daily 12 March 2020

New Vehicle Sales – February 2020

799 New vehicles were sold in February, an increase of 19.1% m/m from the 671 vehicles sold in January, and a 6.4% y/y increase from the 751 new vehicles sold in February 2019. Two months into 2020 and 1470 new vehicles have been sold, of which 638 were passenger vehicles, 721 light commercial vehicles, and 111 medium and heavy commercial vehicles. The first two months of 2019 saw 1,429 new vehicles sold. On a twelve-month cumulative basis, a total of 10,442 new vehicles were sold as at February 2020, representing a contraction of 8.9% from the 11,459 sold over the comparable period a year ago.

A total of 347 new passenger vehicles were sold during February, increasing by 19.2% from the 291 passenger vehicles sold in January. On a year-on-year basis however, February new passenger vehicle sales were 2.0% lower than the 354 vehicles sold a year ago. Year-to-date, passenger vehicle sales rose to 638, reflecting lower annual sales than the preceding 9 years, and an 8.3% decline from February 2019. On a rolling 12-month basis, passenger vehicle sales are at their lowest level since January 2011, highlighting the severity of the slowdown in sales.

A total of 452 new commercial vehicles were sold in February, representing an increase of 18.9% m/m and 13.9% y/y. 386 Light commercial vehicles, 21 medium commercial vehicles, and 45 heavy and extra heavy commercial vehicles were sold during the month. Light commercial vehicle sales rose 10.0% y/y, medium commercial vehicle sales rose 50.0% y/y and heavy commercial vehicle sales increased by 40.6% y/y. On a twelve-month cumulative basis, light commercial vehicle sales have declined by 12.4% y/y, medium commercial vehicles rose by 14.2% y/y, and heavy commercial vehicles rose 17.1% y/y. While the positive 12-month growth in medium- and heavy commercial vehicle sales is positive news, the growth is from a very low base.

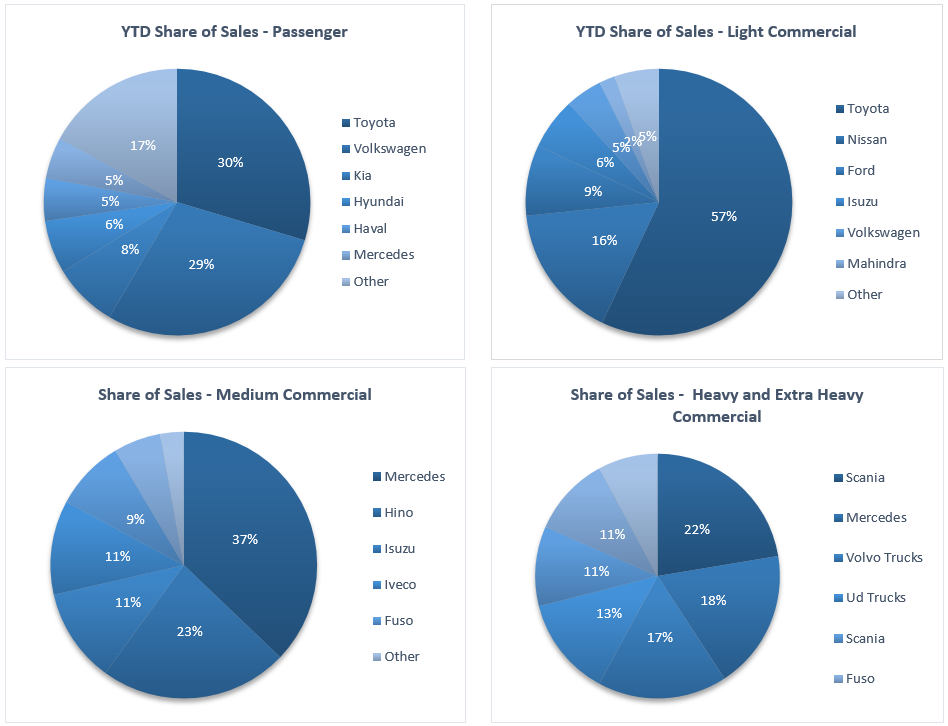

During February, Toyota overtook Volkswagen in terms of year-to-date market share of new passenger vehicles sold. Toyota claimed 29.6% of the market, followed closely by Volkswagen with 28.8% of the market. They were followed by Kia and Hyundai with 7.8% and 6.4% of the market respectively, while the rest of the passenger vehicle market was shared by several other competitors.

On a year-to-date basis Toyota remained the leader in the light commercial vehicle space with a 57.0% market share, with Nissan in second place with a 16.4% market share. Ford and Isuzu claimed 8.6% and 6.2%, respectively, of the number of light commercial vehicles sold thus far in 2020. Mercedes leads the medium commercial vehicle segment with 37.1% of sales year-to-date, while Scania was number one in the heavy and extra-heavy commercial vehicle segment with 22.4% of the market share year-to-date.

The Bottom Line

While the number of new vehicles sold in February is higher than the number sold in the prior two months, the cumultative number of new vehicles sold continues to decline on a rolling 12-month basis, and is trending at the lowest level in ten years. The downward trend in vehicle sales is likely to continue for the rest of the year as there are no indicators that economic conditions will improve substantially any time soon. Historical data indicates that new vehicle sales typically pick-up somewhat in March, however we are of the view that the increase in sales for the month will be relatively small. Recent new vehicle sales figures suggest that vehicle owners are either holding on to the vehicles they already own or purchasing second hand and imported vehicles.